How does billwerk validate the VAT ID of customers?

billwerk automatically checks in two ways whether the VAT ID specified by your customer is valid.

A syntactic check

A query at the VAT Information Exchange System (MIAS / VIES) of the European Commission

Syntax check

The syntax check evaluates the plausibility of the VAT ID entered on the order page. If the entered VAT ID does not consist of the two-digit country code as prefix and a maximum of twelve following alphanumeric characters, the completion of the order is prevented until a syntactically correct or no VAT ID is stored.

VAT Information Exchange System query (VIES; European Commission)

billwerk automatically queries the validity of the VAT identification number stored in the VAT information exchange system VIES of the European Commission after a successful syntax check. Further information on VIES can be found here.

The check verifies if the VAT ID is currently valid. Queries to determine if the VAT ID fits the country of the customer or company name in billwerk are currently not included.

The query is carried out automatically for the following events:

After customer registration

After changing the VAT ID

Recurring for VAT ID already tested:

48 hours before the next regular payroll run (unless the last check was within the last 14 days)

The following statuses can have VAT IDs in billwerk:

Unconfirmed (After saving a new VAT ID, check is still in progress)

Confirmed on (Successful verification with date of verification)

Invalid on (according to the check, the VAT ID is invalid with the date of the last check)

The check is not performed for:

VAT IDs from the same country as you as a merchant

Swiss VAT IDs

UK VAT IDs

If the VAT number is unconfirmed at the time of invoicing, the billwerk system assumes for the time being that the identification number is validly confirmed and continues to apply the reverse charge procedure while fulfilling the other requirements.

Impact of invalid VAT IDs for invoicing in billwerk

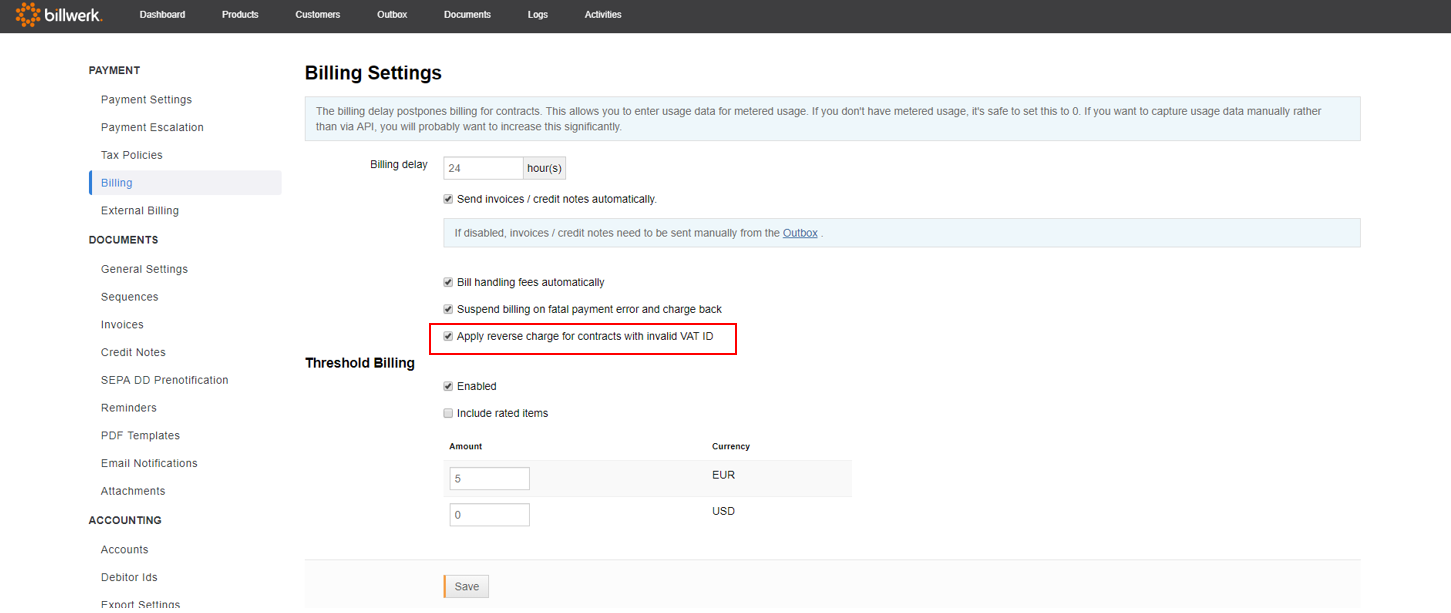

If a VAT ID is invalid according to VIES and the Apply reverse charge for contractswith invalid VAT ID option is deactivated ( see Settings > Billing), recurring billing is automatically disabled in the contract.

Note

Important: If the Apply reverse charge for contracts with invalid VAT ID is activated, the recurring billing is not automatically disabled in the contract.

If the query at VIES leads to the result that the VAT ID of a customer is invalid, this has the consequence that newly generated invoices in contracts associated with the customer are charged with VAT. The reverse charge procedure is not applied, even if the other requirements for it are met. Old invoices without VAT can be adjusted via the invoice correction in this case.

This can be changed in "Settings > billing" via the checkbox "Apply reverse charge for contracts with invalid VAT ID".

Dealing with invalid VAT IDs

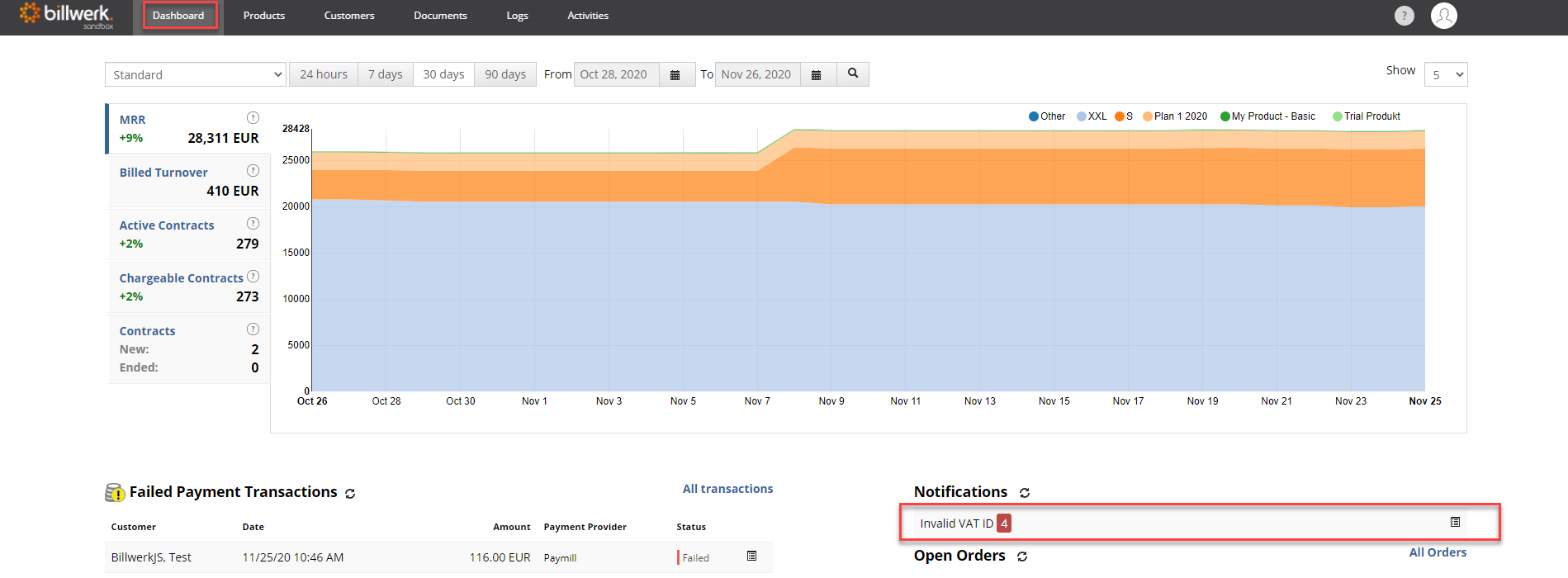

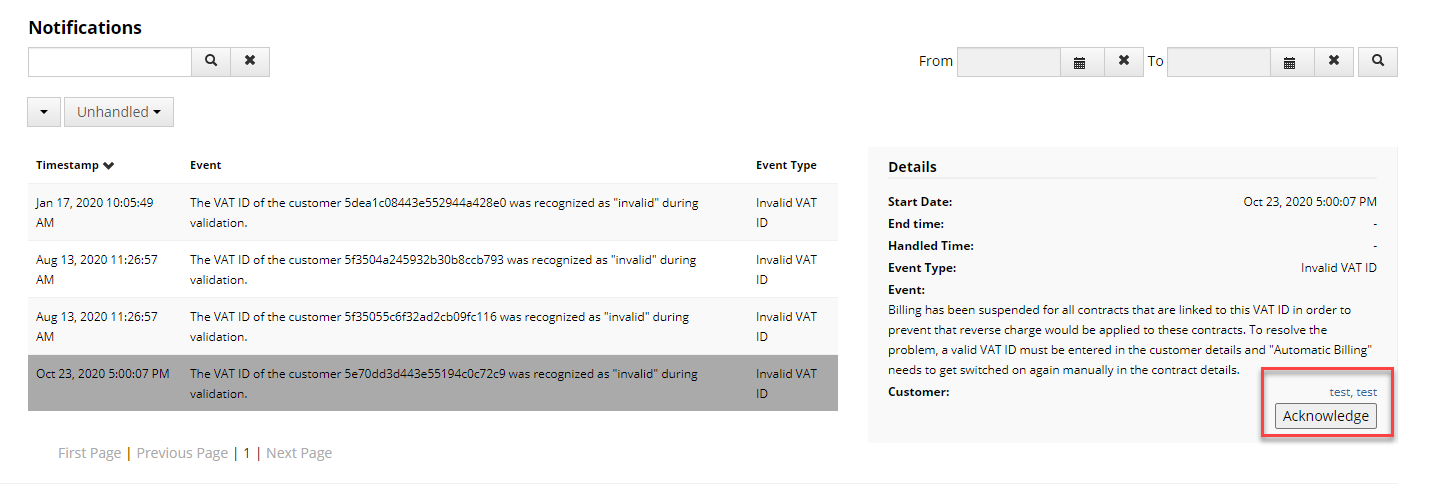

If a VAT ID is marked as invalid, we disabled the recurring billing in all associated contracts and create a notification on our dashboard for you to follow up:

If the automatic billing has been deactivated due to an invalid VAT ID in a contract, this will happen again and again until

a) the VAT ID is marked as valid in a subsequent validation,

b) the VAT identification is removed from the customer or

c) a valid VAT identification is registered.

You should therefore talk to your customer, explain the situation and work towards ensuring that the VAT ID is either valid or removed from the customer.

Note

After the correction, the system will not reactivate the automatic billing, this must be done manually.

The notification can be used as a reminder that there is an open issue. After resolving the issue with the customer you can acknowledge the notification to clean up your dashboard.