PAYONE

Content

Introduction

PAYONE is offering payments with credit card and SEPA direct debit.

Please be aware before starting your implementation of SubscriptionJS on your sign up page, that not all of the proposed payment methods of this PSP support the ProcessPaymentData method:

Payment Method | ProcessPaymentData method supported |

|---|---|

Credit Card with 3D Secure | Yes |

Direct Debit | Yes |

On Account | No |

Configuration in your PAYONE account

billwerk can be used in combination with the PAYONE Payment Merchant Interface (PMI)

Following modules and settings have to be configured in your PAYONE account:

Modul Protect is mandatory (must be applied for and activated by PAYONE)

Refunds API has to be unlocked for all payments (must be applied for and activated by PAYONE)

Mandate generation has to be unlocked (must be applied for and activated by PAYONE)

Client-API access has to be activated (must be applied for and activated by PAYONE)

Creditor ID has to be the same, like the one in your billwerk account

Credit card and/or SEPA direct debit has to be granted

If you wish to receive SEPA direct debit payments from outside Germany, you must have PAYONE activate all countries individually.

The same hash algorithm has to be selected in PAYONE and billwerk (MD5 or SHA2-384)

In the configuration of your payment gateway consider to activate "extendend response-data" for the test and the live mode.

The following safety function must be activated in the Modul Protect:

Bank account check

The following functions are recommended by us:

POS blacklist

Creditcard check

Dynamical regulation of 3D-secure

For some usecases it also might be useful to use the following selection:

BIN check

BIN country filter

IP check

IP country filter

Please contact your PAYONE account manager for further information to the module.

|

Live mode

In principal there is only one payment portal necessary. If you want to use 3D secure for credit card payments you maybe will need a second PAYONE portal:

one for the initial payments; 3D secure has to be activated

one additional for recurring payments (3D-Secure can also be active here, but does not have to be)

If a second portal is necessary, depends on your used acquirer in your PAYONE account. Please contact PAYONE for further information.

Please consider to save the TransactionStatus URL from the PAYONE settings in your billwerk account in the PAYONE portal settings.

Test mode

You only need one portal for the test mode, which can be used in the billwerk settings for both portals. 3D-secure has to be activated.

Webhooks

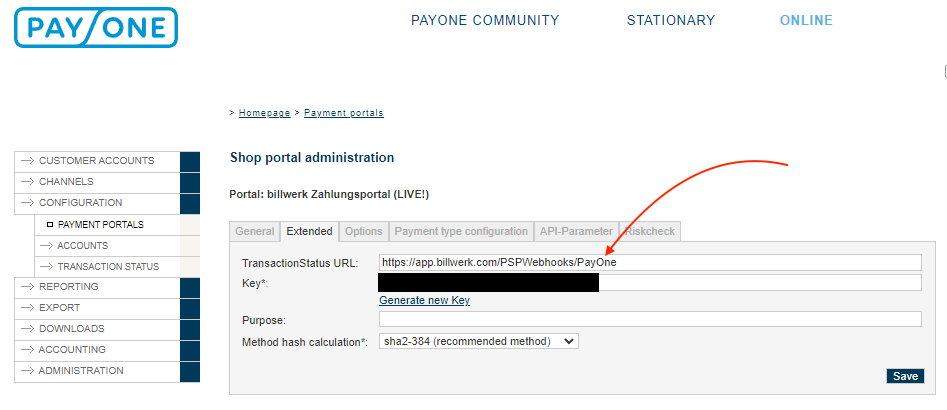

Save the URL for the webhooks that PAYONE sends to the billwerk system in your PAYONE account.

You can refer to the URL of your PAYONE account settings in the billwerk system (see figure above) and enter it in the PAYONE account under "Configuration > Payment Portals > Extended".

Save the setting in your PAYONE account.

Please note that the completion of your PAYONE account may take some time on the part of PAYONE. This account must be set up before you can use PAYONE with billwerk.

Configuration in your billwerk account

For payment configuration, go to "Settings > Payment > Payment settings > PAYONE".

|

You need following information, which you can find in your PAYONE account. All fields are mandatory:

Merchant Id

Subaccount Id

Portal #1 - Portal Id

Portal #1 - Key

Portal #2 - Portal Id

Portal #2 - Key

If you are using just one portal, please insert the same data in portal #1 and portal #2.

You can find them at: "Configuration > Payment Portals > API-Parameter"

|

By selecting the "Mode" you can choose if you want to use the test or live mode.

Save your data after filling the form and activate the wanted payment method in the payment setting overview. Don't forget to save these settings as well. The payment method is now activated in your billwerk account.

Payments on account

(No longer offered, alternatively the CAMT.053 import can be used)

If you want to use payments on account with PAYONE, the feature "Open invoices" has to be unlocked in your PAYONE account.

Pay on account can generally be used in two different options. Either your customers transfer to a trust account of Payone or you give Payone insight into a bank account of yours, where Payone can record incoming payments.

Then activate the payment method in the payment settings in billwerk.

Your customer must specify a unique invoice reference code as the reason for payment for each new transfer. You can have this invoice reference code automatically printed on the invoice as a placeholder. Insert the placeholder {invoice.referencecode} in the "Text payment on invoice (HTML)" area of the PDF invoice template. This will provide your customer with the unique payment reference for the next remittance. If this purpose is specified, the incoming payments can be automatically recorded and assigned to the sent invoice and the contract account.

You can configure the due date of payments in the billwerk payment settings for PAYONE. To do this, go to the PAYONE settings and set the desired due date. The payment due date is thus automatically displayed on the created invoice.

Restrictions

Permanent transfers from your customers are not supported with "Payments on Account". Since the purpose of the transfer does not change in the case of a standing transfer, it is not possible to make a clear assignment to a previously created invoice here. Please inform your customers both in your terms and conditions and on your invoice that this payment mode is not supported.

A mixture of payments on account via Payone and additional payments received on other accounts, which are recorded in billwerk as external payments, is not supported. Incoming payments that have not been transmitted to billwerk must always be assigned via the Payone merchant portal.

No explicit purpose can be issued on dunning notices that can be used for automatic posting at Payone. Customers must pay the open invoices with the purpose of use issued on the original invoice.

Configuring SEPA reference line

You can configure the SEPA reference line manually. For more information, see the article Configuring SEPA reference.

Test data

You can use following payment data for your tests:

Credit card

With 3-D secure:

Credit card number | CVC | 3-D secure password: | Expiry date | |

VISA (Verified by VISA) | 4012001037141112 | Three random numbers | 12345 | Any date in the future |

MasterCard (MasterCard SecureCode) | 5453010000080200 | Three random numbers | 12345 | Any date in the future |

MasterCard (MasterCard SecureCode) | 27209900000000071 | Three random numbers | 12345 | Any date in the future |

Without 3-D secure:

Credit card number | CVC | Expiry date | |

VISA | 4111111111111111 | Three random numbers | Any date in the future |

MasterCard | 5500000000000004 | Three random numbers | Any date in the future |

American Express | 340000000000009 | Three random numbers | Any date in the future |

JCB | 3088000000000009 | Three random numbers | Any date in the future |

Carte Bleue | 4973010000000004 | Three random numbers | Any date in the future |

Diners Club | 30000000000004 | Three random numbers | Any date in the future |

Discover | 6011111111111117 | Three random numbers | Any date in the future |

SEPA direct debit

You have to configure a creditor-id in "Settings > Account > Company > Creditor Identifier" (e.g. DE98ZZZ09999999999) to use SEPA direct debit.

IBAN | DE85123456782599100003 |

BIC | TESTTEST |

Account holder | Every random name |

Result | Successful direct debit |

On account payment

When you are testing "PAYONE On Account" you can use the following names:

Last name | Test case |

Payer | The invoice is paid |

Underpayer | The invoice is paid partially |

Overpayer | The paid amount is higher than the invoice amount |

Neverpayer | The invoice is not paid |

Customer data

PAYONE defines customer data fields which are mandatory, otherwise the payment will fail (e.g. errorcode = 901). These fields are mandatory:

Last name

First name (If there is no company name)

City

Country

Limitations

SEPA Direct Debit payments

For each IBAN only one SEPA Direct Debit mandate can be created in PAYONE. All additional mandates for this IBAN reference the existing mandate.

When creating a mandate, the current date is set as mandate signature dates by PAYONE. The interface does not support passing on a custom date.

Please inform yourself before using Europe-wide SEPA direct debit, if this is possible with your PAYONE account, by contacting the PAYONE support.

Debtor management

PAYONE offers its own debtor management system, which cannot be used in combination with billwerk, because when using billwerk, billwerk must be the leading accounts receivable management system. Functions in the debtor management system of PAYONE such as "Charge off receivables" are not synchronized with billwerk.

Contact data:

PAYONE merchant service: sales@payone.com ; Phone: +49 431-25968-400