Product-based accounting

Table of contents

What is product-based accounting?

Prerequisites

Configuring product-based accounting settings

Product-based postings

Validation

Saving of product-based account settings

Adding a new product

What is product-based accounting?

It is a form of allocating revenue to individual products.

In general, it allows merchants to record revenues from each product using the accounting export, independently of the used accounting system. Revenues can be monitored based on the product that has been sold.

Prerequisites

You need to fill in the product-based accounting settings depending on the product section (Without product/Plans/Components etc.)

Configuring product-based accounting settings

You have to configure your settings first to change into product-based accounting.

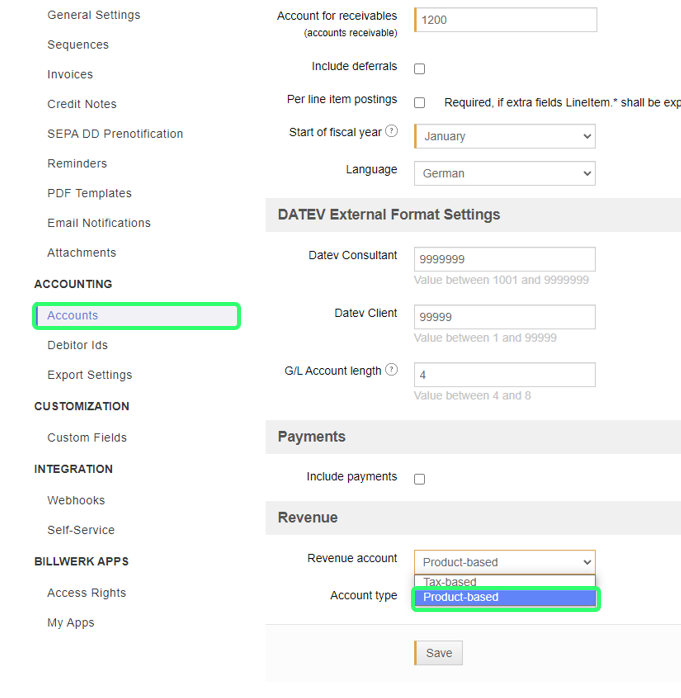

In Settings, got o the Accounting section in the left navigation panel. Click on Accounts.

In the General Settings tab, in the Revenue section, click the Revenue account drop-down list.

Select the option Product-based.

Basing on the chosen Revenue account and Account type (Gross/Net), the Account for tax should be configured as stated below:

DATEV

SAP

Gross

No tax-fields need to be filled

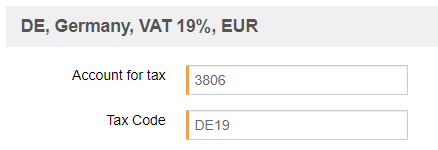

Tax Code for each combination of Country+Tax Rate+Currency needs to be filled in, e.g.:

Net

Account for tax for each combination of Country+Tax Rate+Currency needs to be filled in, e.g.:

Account for tax for each combination of Country+Tax Rate+Currency needs to be filled in, e.g.:

Note

Write-off accounts for taxes will be displayed only if there is at least one written-off contract for the entity for the specific combination of Country+Tax Rate+Currency.Go to the Product-based Accounts tab and fill in the Account names for all products.

Note

Write-off account fields will be displayed only if there is at least one written-off contract for the entity.

Product-based Postings

If product-based accounts are configured, they will be applied when creating revenue and write-off postings.

Validation

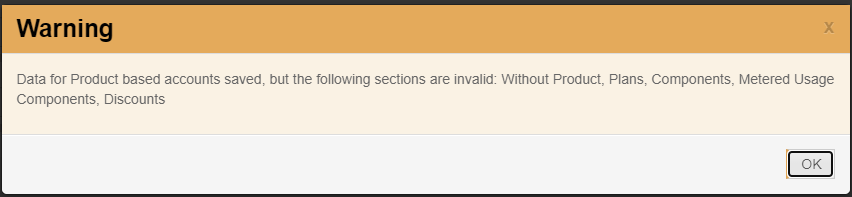

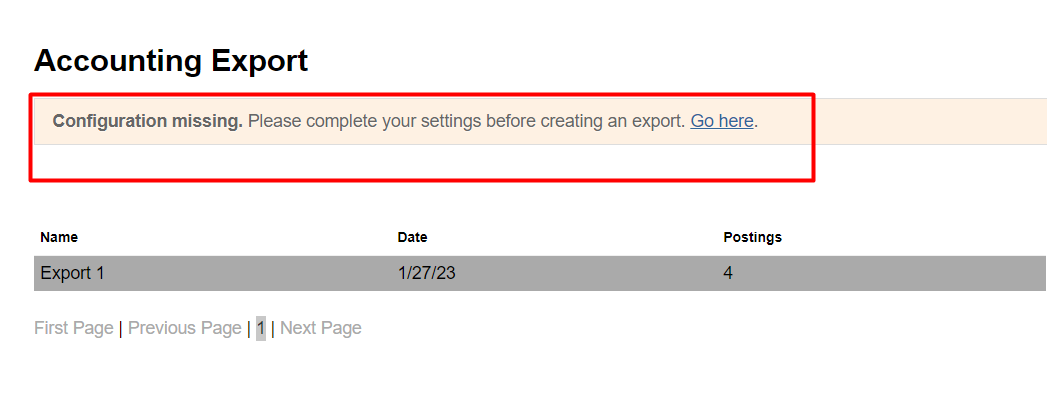

It is possible to save product-based accounts even though not all fields are filled. In this case, the user sees a warning and will not be able to create an Accounting Export.

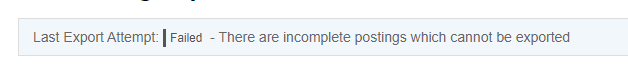

Let us assume that product-based accounts are chosen for revenue accounts, but not all product-based accounts are configured. When you now try to create an Accounting Export, you will see a message that not all necessary accounts are configured.

Saving of product-based account settings

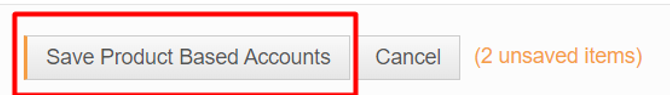

Data can be saved for one of the account sections only and they will remain unsaved for the second one if you don't click the save button. In this scenario, we are going to create a partial save example:

Create five new products in two different sections e.g. Plans and Components.

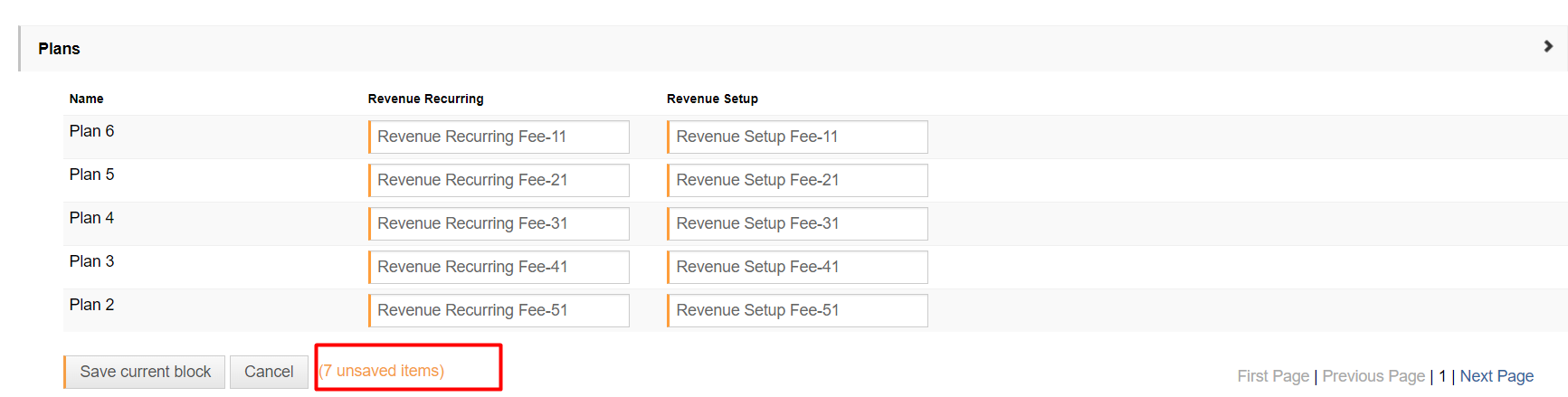

Open Accounting Export Settings > Product-based Accounts tab and fill in all pages of corresponding settings as below:

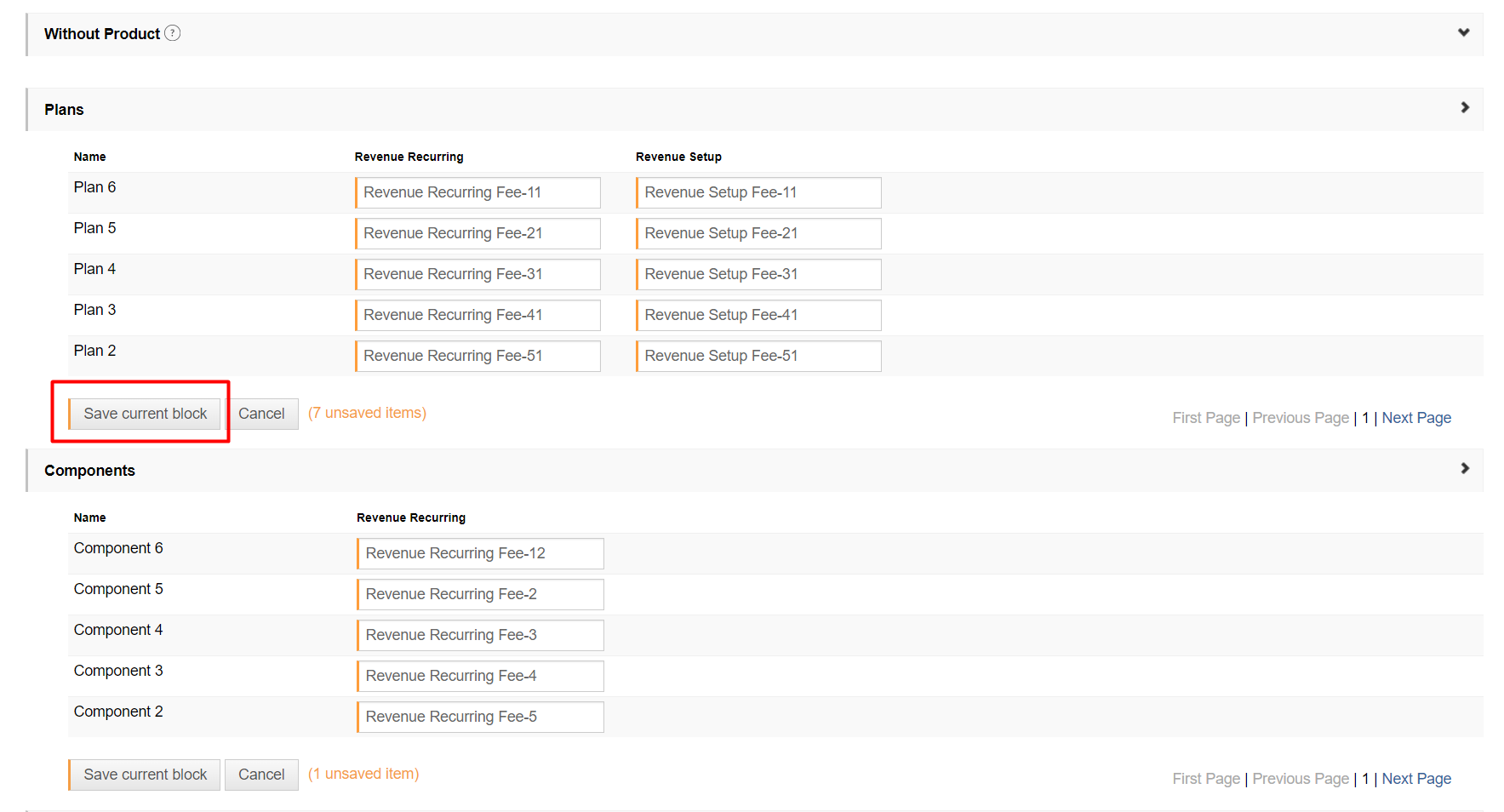

Click on Save current block in the first section (here Plans).

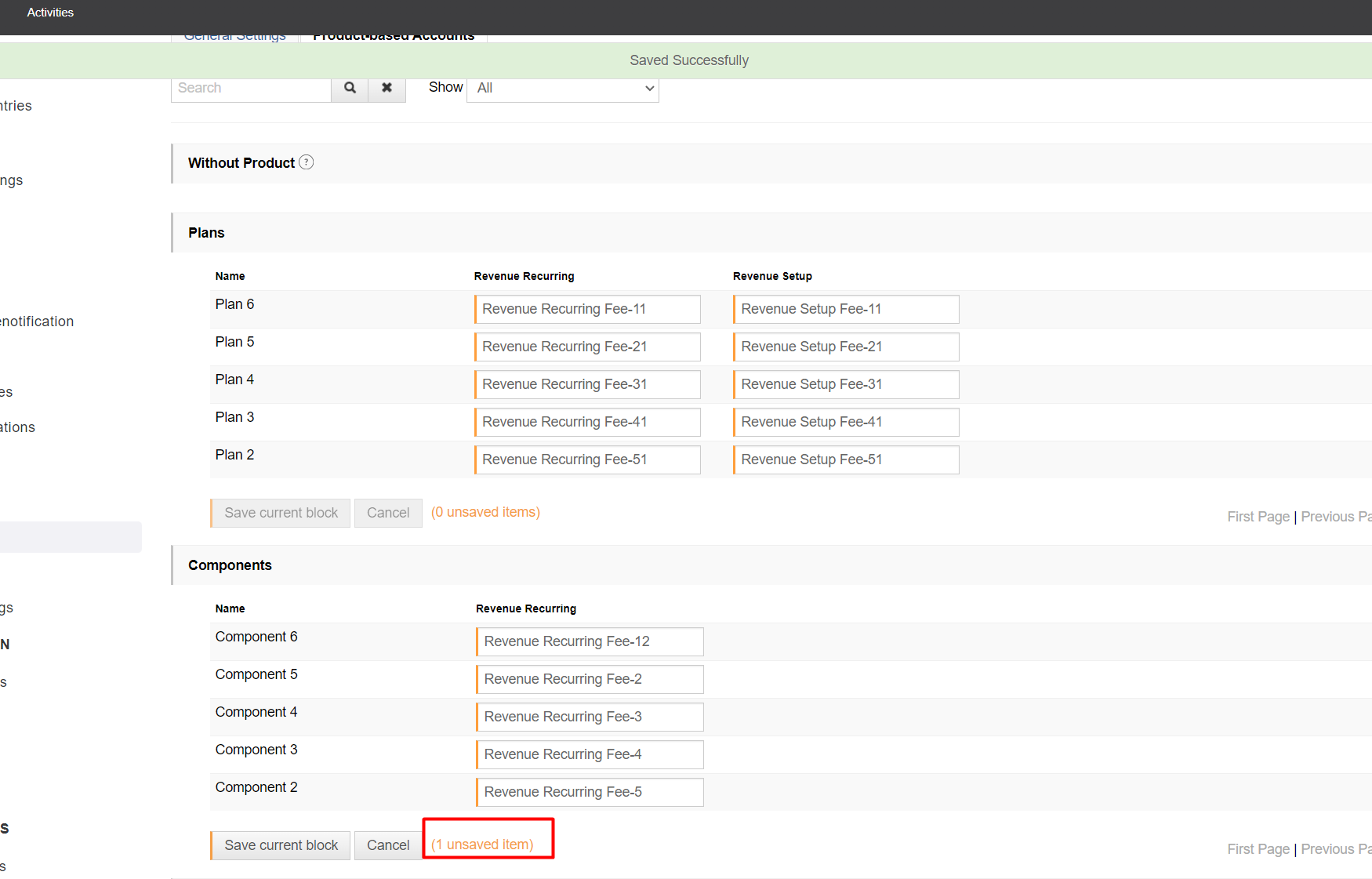

After doing some changes in the second section, the data will be savedfor the first section only (Plans) and they will stay unsaved for the second section (Components).

Note

Notes:

SaveProduct BasedAccounts button at the bottom of the Product-based Accounts tab will perform save of all sections that remained unsaved.

When you click Save on General Settings tab page, postings will be adjusted every time.

Adding a new product

After creating a new product, settings become invalid. Here is the example:

Add any new product (Plan, Component, Discount etc.).

In the Accounting Export, the warning will appear, settings will become invalid:

Note

The same happens for generating a new unique tax section on the General Settings page.

Notes:

After adding a new product, the settings become invalid immediately after changes. For generation of a new tax section, you have to wait for Postings action to have new section added.