How does billwerk create deferrals?

The billwerk accounting export offers the possibility to automatically create deferred income and dissolve it over time.

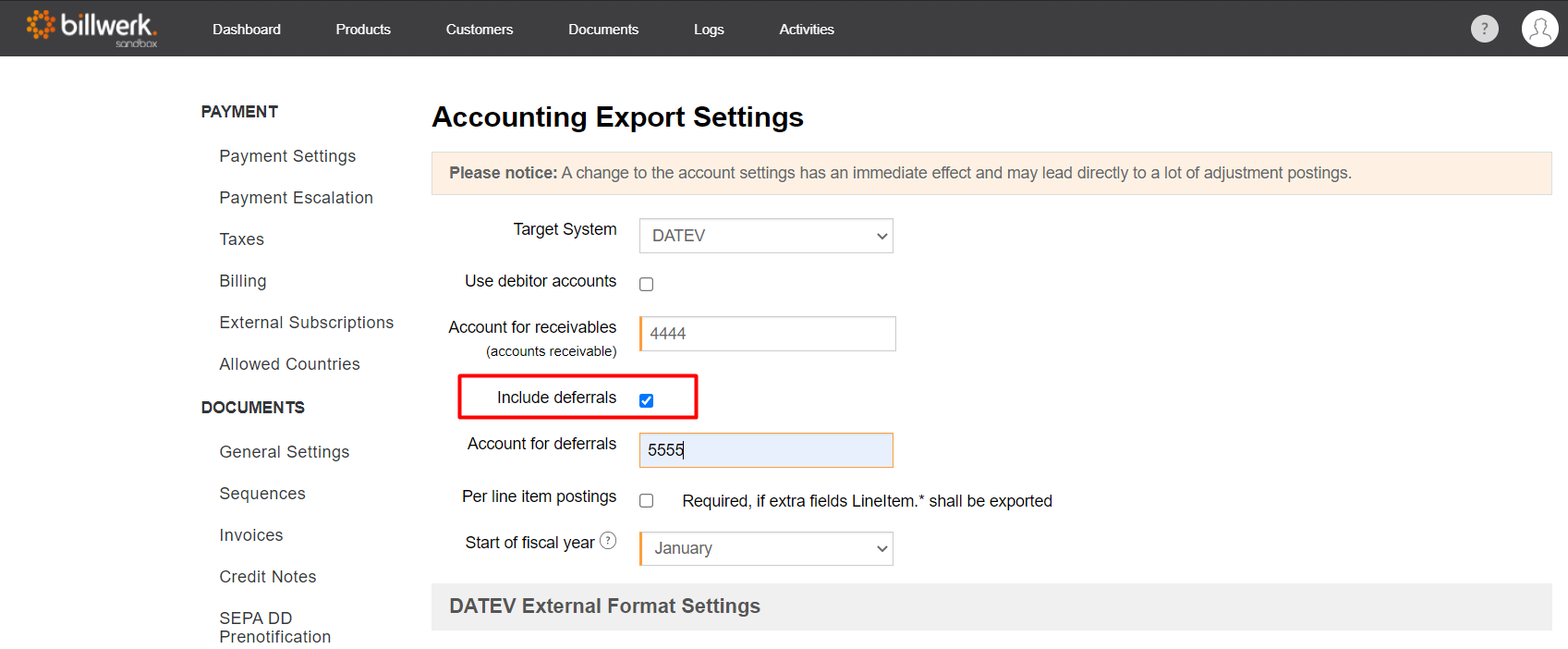

The setting "Include deferrals" under "Settings > Accounts" controls this process:

How are deferred income items created in billwerk?

The deferrals are formed based on the net amount of a receivable, since the value-added tax for the entire receivable is due immediately.

The net amount of each invoice line is distributed evenly over the delivery period.

The relative portion of the net amount falling in the month of invoicing and in the past is not deferred. The remaining portion is deferred.

Note

The deferrals are always aggregated for the entire invoice, even if the posting are generated per line item.

Different delivery periods of different invoice lines are correctly processed when resolving the deferrals.

The deferrals are dated to the respective date of the bill.

How are the deferred income items on the liabilities side reversed in billwerk?

When the deferrals are created, postings that dissolve the deferrals are also created in the posting journal. These are then inserted into the financial accounting export with every new month and are dated to the last day of the respective month.

The deferral resolution per month is calculated based on the share of the month on the total deferral period.

What happens if an invoice for which deferrals were created is reversed?

If unresolved deferrals still exist at the time of the reversal, it is corrected accordingly. This also applies to the deferral resolutions.

Example for postings in billwerk including their deferrals:

Example invoice:

Invoice amount: EUR 120 net, EUR 142,80 gross

Product price: EUR 120,00 per year

Delivery period: 24.01.2019 06:00 - 24.01.2020 06:00

Postings:

24.01.2019 - 10031 to 8400 - 142.80 EUR - Document no. RE-0120

24.01.2019 - 8400 to 0990 - 117.50 EUR - "Abgrenzung RE-0120 bis 2019-02"

28.02.2019 - 0990 to 8400 - 10.00 EUR - "Abgrenzung RE-0120 aufl. 2019-02"

...

31.12.2019 - 0990 to 8400 - 10.00 EUR - "Abgrenzung RE-0120 aufl. 2019-12 "

31.01.2020 - 0990 to 8400 - 7.50 EUR - "Abgrenzung RE-0120 aufl. 2020-01"

Posting key

The posting key "40" is set for deferral postings as well as deferral resolutions. This suppresses the automatic posting, the sales tax remains unchanged. For reversed deferrals and deferral resolutions the posting key "80" is set.