Payment on Account with virtual IBANs

Table of contents

Introduction about vIBANs

Configuration of payment on Account with virtual IBANsonfiguration

Access / Pricing

Step 1: Sign-up to the service

Step 2: Activate the payment method

Step 3: Configure payouts

Step 4: Adjust invoice templates

Deactivation

Create a contract with virtual IBAN

Make a payment with vIBAN

Daily payouts logs

Introduction about vIBANs

Note

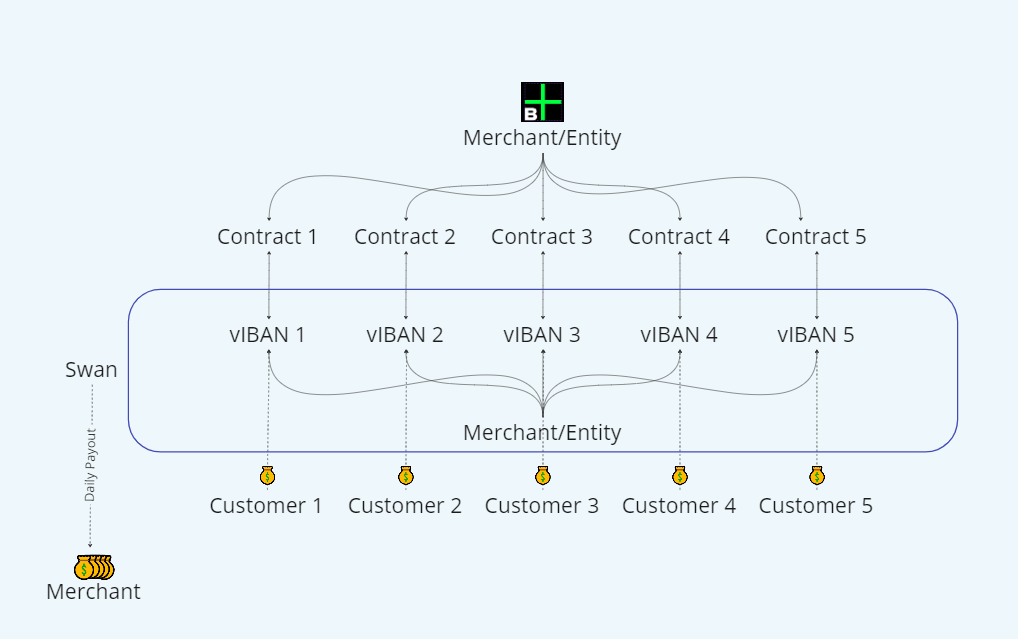

Note: Please note that this is a paid feature. If you are interested, please request the license by contacting our sales department.Virtual IBANs facilitate for merchants and customers to handle On-Account-payments.

This new functionality consists of a fully automated reconciliation process. New dedicated IBAN are created for each contract, and you can keep track of the payment transactions. Matching with contracts can be done all the time, without the need for a proper reference text.

In a nutshell: Customers will not have to write specific references. Merchants will not have to import files or process those payments manually.

Note

As of February 2023, only IBANs from France and Germany can be issued (FR, DE):

The BIC codes for the banks are:

Germany: SWNBDEBBXXX

France: SWNBFR22XXX

Available in all Euro-zones with an EUR currency.

vIBANs are not activated by default. It has to be ordered and activated.

This feature extends the current On-Account-functionality, but the previous options are still available.

Refunds are not supported through vIBANs, you need to trigger them for your own bank.

Chargebacks are not possible.

Configuration of payment on Account with virtual IBANs

Access / Pricing

This feature is a paid feature. The costs include a monthly fee to access the service and some costs per transaction.

Please contact our Sales or Customer Care department to get more information about the costs and to activate the license.

Step 1: Sign-up to the service

In order to configure the Payment on Account feature with virtual IBANs, please follow these steps:

Go to Settings > Payment Settings > Black-Label Providers > On Account (virtual IBAN).

By clicking the button Sign-up to activate the feature, you are redirected to our technical partner. Please provide the following information to finalize the sign-up:

Note: Documents required can depend on your legal structure.

For most companies, please prepare:

A proof of company registration (issued within the last 3 months):

Handelsregister / Unternehmensregister, KBIS...

Articles of associations

List of ultimate beneficiary owners (UBOs)

You can leave and return anytime until all necessary data is provided during the signup. The re-entry is possible through Complete sign-up button:

If you provided all necessary data, but the verification is not completed yet, you will see the status Pending verification on the Settings On Account page:

Once the verification process is complete, the status is updated to Verified.

Step 2: Activate the payment method

As soon as status is changed to Verified, the status of the payment method changes to OK and can be activated.

Note

Note: Only one "On Account" option can be enabled at the same. Switching the activated option does not affect already existing contracts, and will only apply to new contracts or contracts changing their payment methods after activation.

If you want to create virtual IBANs also for existing contracts, we can support you, please contact Customer Care.

Step 3: Configure payouts

The money received through virtual IBANs is temporarily stored on a dedicated bank account within our partner bank. To receive the funds on your main bank account, you need to configure payouts with this step.

Payouts are done automatically every day. All the money received the previous day is transferred, without reserve. You can see details of those payouts in the Payout logs.

Now that you successfully signed up to the service and the verification process is through, you can proceed by configuring the payouts.

Please go to Settings > Payment Settings > On Account (virtual IBANs) and click on the Edit icon on the right.

Then fill in the IBAN for payouts to a final bank account of the merchant in the text field.

Click on the Save button. The process of authentication & consent of the payout will start.

Note

Note: If you enter the IBAN, quit the page and then return later, the IBAN will be is still available. The process needs to be started by clicking the Save button.You receive two messages on the mobile you provided during the sign-up.

The first contains the link for the authentication.

The second allows you to confirm the payouts and shows a summary of the data you provided.

You can check the success of your setup on the Settings On Account (virtual IBANs) page. The payouts are now enabled:

Change bank account for payouts

If you are changing bank, you can change the IBAN for daily payouts anytime, you simply have to add the new IBAN into the IBAN for payouts text field and save.

Step 4: Adjust invoice templates

Your customers need to know where they need to transfer their payments to. For that, we have introduced a new placeholder Contract.IBAN and new payment texts can be added on the invoice when this payment method is selected.

Note: If your invoice PDF template already includes your bank details in the footer, consider removing them or making a note in the text to avoid customer confusion.

Deactivation

To completely deactivate the paid feature, please contact Customer Care.

Create a contract with virtual IBAN

If you have activated virtual IBANs and the customer chooses On Account, the payment method with vIBANs is set.

Every new contract with selected On Account (virtual IBANs) and every contract switched to On Account (virtual IBANs), gets payment method On Account with virtual IBANs.

Please read this article to learn:

How to change to payment method On Account (virtual IBANs).

How to change the payment method to other than On Account (virtual IBANs).

How to create the contract with a virtual IBAN.

Make a payment with vIBAN

Now that you have created a contract using virtual IBAN, your customers will see their specific IBAN on their invoices.

For your customers, this solution is totally transparent. They will simply do a normal SEPA bank transfer to this IBAN. They can choose to indicate the contract or invoice reference, but it's not required, and the reconciliation will be done for you automatically in any case.

As soon as the payment has been received (1-2 days for standard transfer, few seconds for SEPA Instant), it will be accounted for in the contract ledger and assigned to the relevant invoices.

Daily payouts logs

As you already know, daily payouts need to be configured in Payment Settings section.

Please navigate to Admin UI > Logs > Virtual IBANs Payouts to see the payments that are triggered automatically on a daily basis.