Questions and answers about DATEV accounts

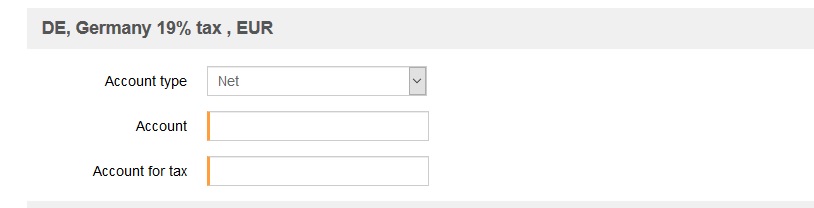

Q: Should I choose "Gross" or "Net" for the revenue accounts?

A: This depends on the accounts used in DATEV. If you select "Gross", billwerk assumes that you are using an automatic account for these revenues. If you select "Net", a separate account must be specified for posting the tax.

Q: How is it prevented with an automatic account that the sales tax is written off for accrual postings?

A: The posting key "40" is set for accrual postings and accrual reversals. This suppresses the automatic posting and the tax on sales/purchases remains unchanged.

Q: Does billwerk support the posting of revenues via the SKR 03 account 8331 "Revenues from electronic services taxable in another EU country"?

A: No, not at the moment. billwerk uses an automatic account when selecting the "gross" method.

Q: How are reversed accruals and deferral reversals marked in DATEV FiBu Export?

A: The posting key "80" is set for reversed accruals and deferral reversals.

Q: How are reversed sales and payments marked in DATEV FiBu Export?

A: The posting key "20" is set for reversed sales and payments.

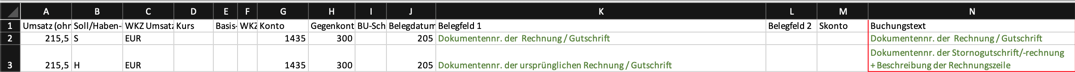

Q: What booking text (Buchungstext) is output for invoices and credit notes?

A: The document number of the respective invoice/credit memo is output in the booking text for all booking types. For accounting records that refer to exactly one invoice row, the description of the invoice row is attached.