How can I configure the accounting export?

The Accounting Export regroups all configurable financial accounts. You can export into DATEV or SAP. Each export is a ZIP archive of one or multiple files.

Summary

Prerequisites and considerations

Revenue accounts and accounts for means of payment can only be configured after:

First posting for the respective country and

Tax rate has been created due to a receivable posting after an invoice or when the first payment has been made using the means of payment.

Note

Please note that if you change the account assignment, postings that have already been exported and are affected by this change are automatically corrected.

billwerk creates a reversal posting against the previous account and a new posting with the changed account assignment.

Posting "drafts" - i.e. postings that have not yet been exported - are not affected by this.

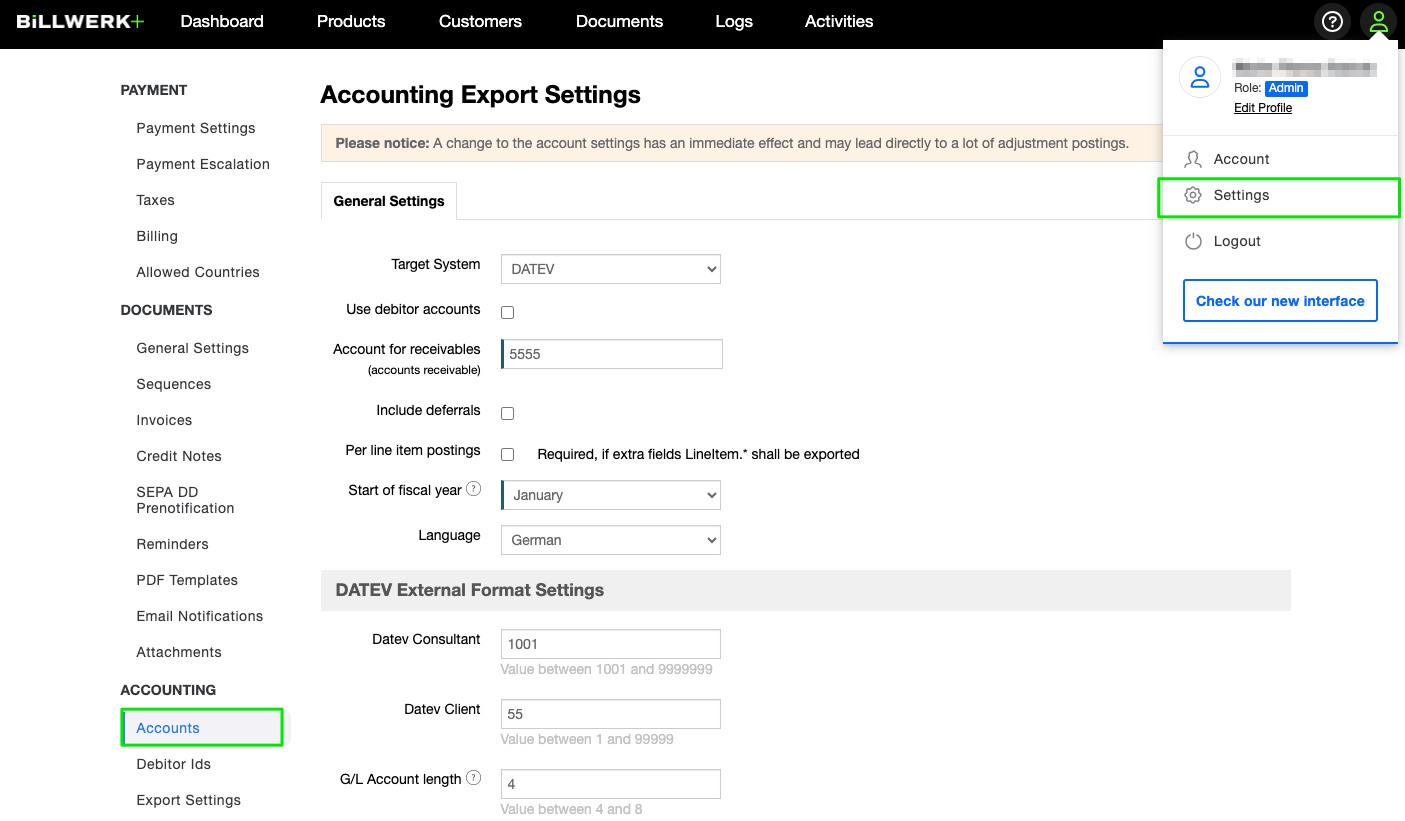

Access to the Accounting Export Settings

To configure the accounting export:

Click on your profile and then Settings.

On the left hand navigation, in the ACCOUNTING section, click on Accounts.

General settings

The first settings you can configure are the same for SAP and DATEV.

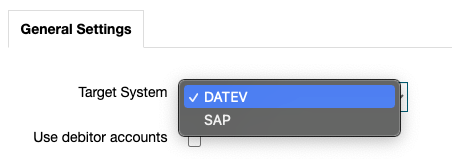

Target System: You can choose for which target system the financial accounting exports should be created.

You can choose between the following target systems:

DATEV (this option is also available if you use the Lexware format)

SAP

If you use the EXTF (DATEV External Format) you can additionally store your Datev Consultant and your Datev Client.

Use debitor accounts: billwerk uses the debitor ID saved for the customers as the customer debitor number.

Note

Note: This means that before exporting financial accounting data, please ensure that all customers have such a debitor ID.Note

For verification, go to Settings > Accounting> Debitor Ids: Here you can also create debitor IDs for customers who are already in your account and do not yet have one.Deactivate this option to post the receivables to the G/L account Account for receivables.

Include deferrals (Accrued expenses and deferred income): billwerk automatically generates deferred income for all revenues whose performance period exceeds a calendar month. You can set up an account from your financial accounting. You can find further information in this article.

If you activate this option, you can decide wether or not you would like to include deferrals.

Activating this option, you can set an set a(n)

Account for deferrals: Available for SAP and DATEV

Tax Code for deferrals: Available only for SAP

Per line item postings: You can specify whether the accounting records should be summarized per invoice/credit note or whether a separate posting should be created per line item.

Start of fiscal year: The month of use. By default, January is used as the beginning of the year.

Language: You can determine the language of the accounting export on entity level. By default in German, but can be set to English.

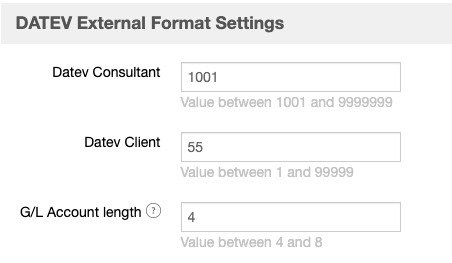

DATEV External Format Settings

Datev Consultant, Consultant number for data exchange with self-booking clients. The use of the same consultant number and client number (Datev client) promotes a smooth data exchange with the law firm for clients who prepare their own accounting with DATEV accounting programs. See the following DATEV help center article.

G/L Account lenght: In DATEV it is not possible to decrease the length of the field "G/L Account length" after it has been increased. Read more.

These fields are only shown, if you set DATEV as a target system. There are no corresponding fields for SAP.

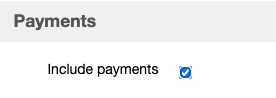

Payments

The majority of payments recorded in billwerk are usually made automatically.

billwerk is also automatically informed about the status of each individual payment.

Include payments: Activate this option to export all recorded payments for your financial accounting. For each means of payment used, a separate financial accounting bank account can be deposited.

Revenue

The revenue accounts are managed in the next section of the financial accounting account configuration. The options are changing according to the target system chosen at the top.

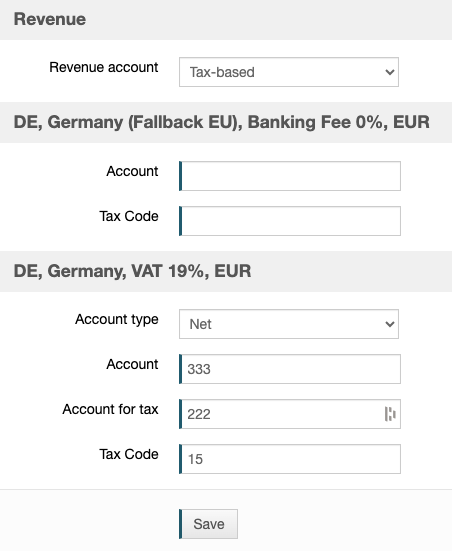

DATEV

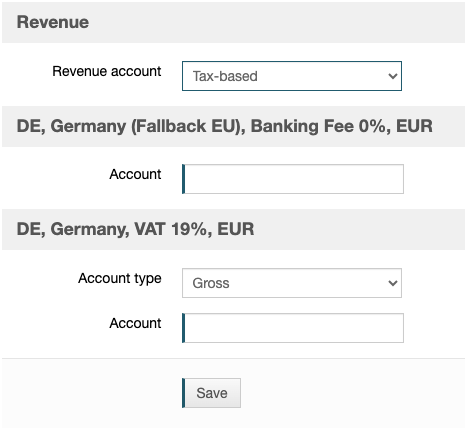

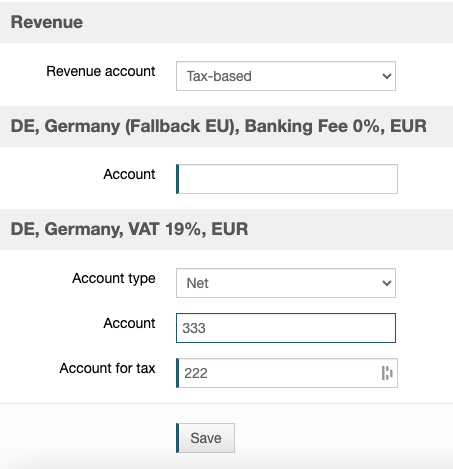

The displayed fields are changing again according to the choice of Revenue account:

Tax-based: You can set up two accounts separated by tax rate.

Account type Gross

Account: Revenue account

Account type Net

Account: Revenue account

Account for tax: VAT account for the tax rule applied

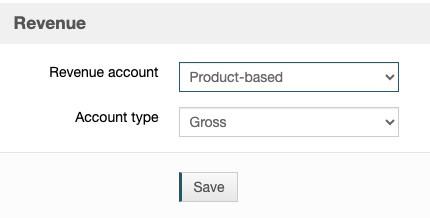

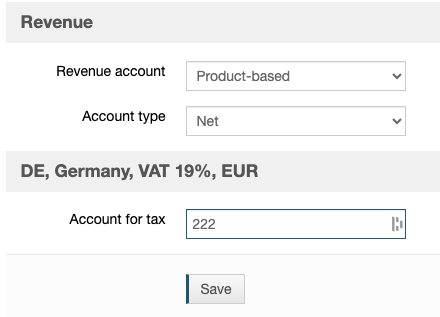

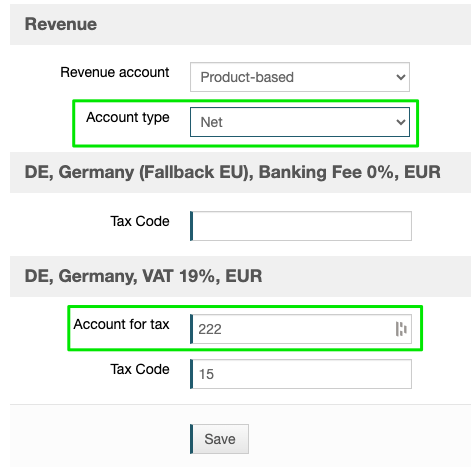

Product-based:

You can select the account type.

> Account type Gross:

Specify the revenue account. The "gross" account type is used if the financial accounting system supports automatic accounts and is to make the split posting for the sales tax included.

> Account type Net:

Select the Account for tax for the tax rule applied.

Note

Note

For more information about product-based accounting, please read the following article: Product-based accounting.

SAP

The displayed fields are changing also according to the choice of Revenue account:

Tax-based: You can set up two accounts separated by tax rate.

Account: Revenue account

Tax Code: Tax on sales / purchases code (see table T007A in SAP)

Account type Net

Account: Revenue account

Account for tax: VAT account for the tax rule applied

Tax Code: Tax on sales / purchases code (see table T007A in SAP)

Account type Gross

Account: Revenue account

Tax Code: Tax on sales / purchases code (see table T007A in SAP)

Product-based: You can select the account type.

> Account type Gross:

The "gross" account type is used if the financial accounting system supports automatic accounts and is to make the split posting for the sales tax included.

> Account Type Net:

Select the Account for tax for the tax rule applied.

Note

Note

For more information about product-based accounting, please read the following article: Product-based accounting.