FarPay - Betalingsservice

Summary

Impact on timing for Betalingsservice

FarPay is a Danish payment service provider based in Copenhagen. The B2B fintech company was founded in 2014 and specialized in the IT & Software and SaaS industries in the following years. By connecting FarPay with the accounting solution, companies are able to automate and streamline manual processes.

In Billwerk+ Betalingsservice can be provided as a payment method via the integration of the payment service provider FarPay.

Note

What is Betalingsservice?

The direct debit Betalingsservice is used by about 90% of people in Denmark. It is a system for automatic payments, where the first payment is made manually and the recipient sets up subsequent payments for automatic payment on the due date. The automatic payment continues until the payment agreement is canceled.

The advantage of Betalingsservice is that the recipient does not have to physically pay the bills themselves and no reminders are sent, as all bills are paid automatically and on time. The customer receives a monthly payment overview - typically in e-Boks or online banking - where you can see what you pay for and when.

This payment solution is most beneficial if you have a large number of private customers, but it can also be used for B2B customers.

Note

Important

Please be aware before starting your implementation of SubscriptionJS on your sign up page, that the ProcessPaymentData method is only supported by this PSP for the payment method Betalingsservice.

FarPay Integration Setup

Note

Please note:

If you are not yet a FarPay customer, please use this form to get in touch with their customer service.

Once you are a customer and you got your credentials for the customer portal, you can follow these steps.

Log into your FarPay portal.

Go to Settings and scroll down to API access.

Copy your API Key or click on Generate to create a new one.

In a new tab:

Open Billwerk+.

Click on your profile in the upper right corner.

Then click on Settings.

On the left hand menu, click on Payment Settings.

In the list of White Label Providers , scroll to FarPay.

Click on the Edit icon at the end of the line.

The Settings FarPay page opens.

Enter the API key from the FarPay portal to the field.

Copy the Server communication URL you see in the blue box.

Click on Save.

Contact the Far Pay Support via email support@farpay.dk.

Please send them the following message:

We would like to set up the integration between FarPay and Billwerk. In order to establish the connection, we would need to configure JSON notifications using a Server communication URL. Here is the one we just generated in Billwerk: (Please insert the URL from step 12).

The FarPay support will then finalize the setup.

Note

Great! You just established the connection between FarPay and billwerk+.

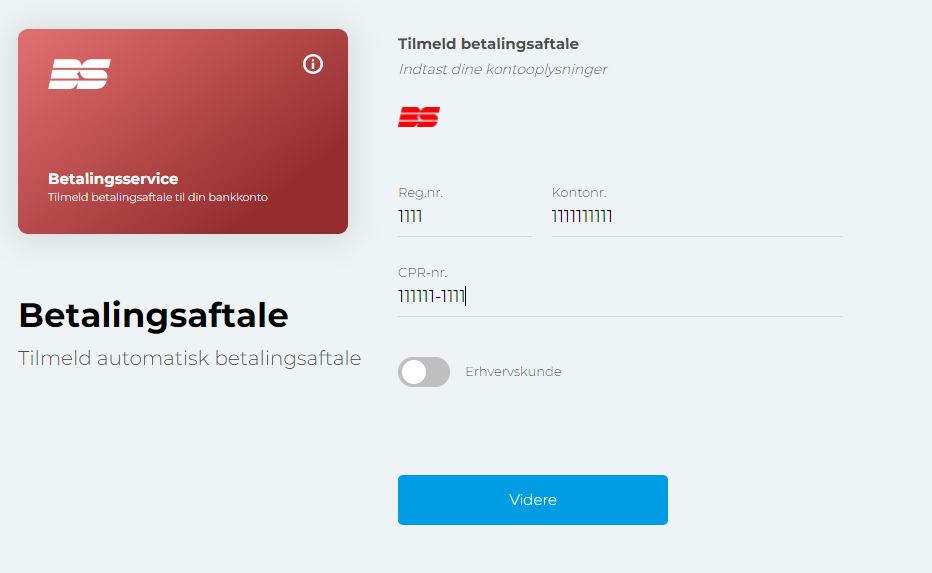

Betalingsservice CheckOut

Once you integrated FarPay to Billwerk, your customers can choose the new payment method.

They will be transferred to the Betalingsservice Payment Window:

Here your customers need to fill in the following data:

Reg. number

Account number

CPR Number for customers

CVR for companies

Note

Switch the toggle Erhvervskunde to change the mode from private to business customers.

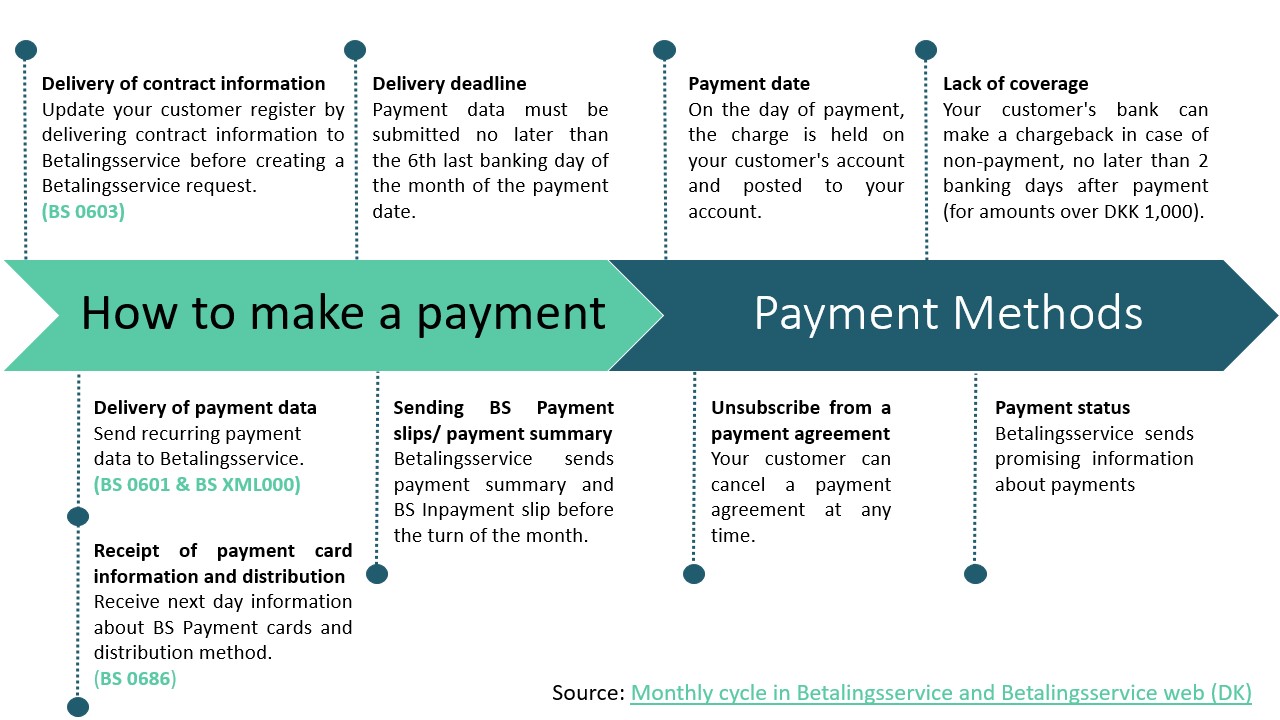

Impact on timing for Betalingsservice

Here are some specifications on timing that might influence your payment processes. There is a fixed routine every month for submitting payment information to Betalingsservice. There are fixed times that must be adhered to when you make collections.

Direct Debit file exchanges between Betalingsservice users and Nets: Monday to Friday, excluding public holidays.

Deadline for submitting files to Betalingsservice: 9:00am (CET) six banking days before the end of the month preceding the month in which you wish to take the payment.

Example: You need to collect a payment in August. The payment should be submitted to Nets no later than the 6 working days before the end of July.

This figure shows you the monthly cycle in Betalingsservice:

Test Data for Betalingsservice

FarPay processes any data matching the pattern:

Reg.N° | Any 4 digits |

Account N° | Any 7-10 digits |

CPR-N° | 01XXXX-XXXX |

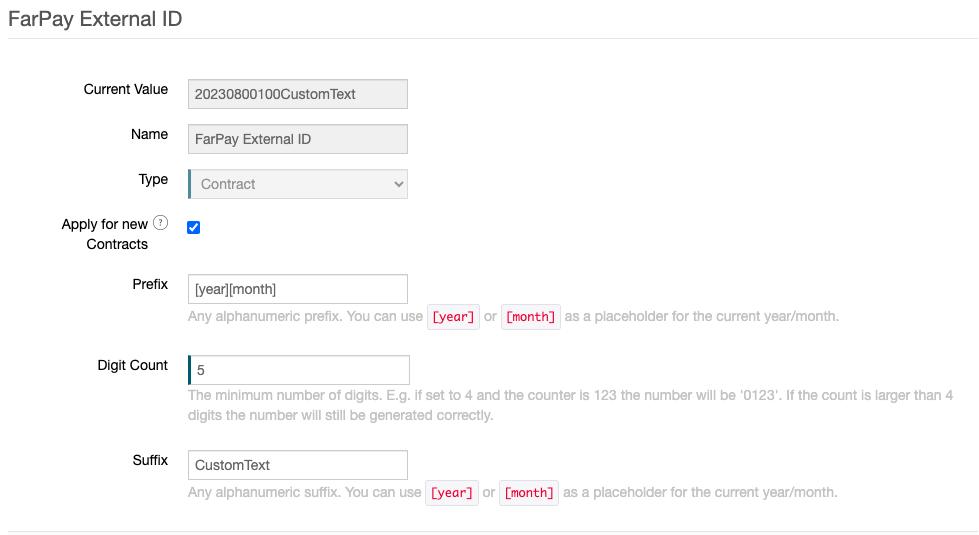

ExternalID as Customer Number

In the context of FarPay, we suggest to use the ExternalID coming from the contract in sequences. This ID can be used to sent a ID to FarPay that refers to a customer and a contract in Billwerk, instead of using a random sequence.

Prerequistes

Reminder: In Settings > Sequences you can customize the naming of invoices, credit notes and dunning notices.

You can select Contract as a Type in order to use the External ID and add Prefixes, Suffixes etc. to adapt the sequence to your business needs.

Note

Note: The customer ID is also called “Kundenr.” on the bank statement of Betalingsservice.

Contact Customer Care team

Once you set up your sequence and the integration with FarPay , our team needs to intervene to apply your settings. Please contact them via email at support@billwerk.com.

Caution

This intervention needs to be done every time you:

Create a new sequence.

Delete a sequence.

It is not necessary, if you:

Change the API key in FarPay settings.

Edit an already existing sequence (edit Prefix/ Suffix/ Digit count)

Then all changes are applied automatically.

Result

After signing up in the FarPay portal you can see that the external id is displayed in the Customernumber field: