Tax Management

With our Tax Management functionality you can set up Billwerk+ to automatically determine the value-added tax (VAT) rate to be applied for a purchase based on the country of your customers.

With this you can easily sell you products across Europe while we take care of applying the taxation logic for you.

This functionality enables you to manage different business models with different tax rates in one Billwerk+ account.

Notice

While our Tax Management functionality is powerful, if you do not want to use it, Billwerk+ will continue to work as it used to with the flat % VAT rates you have configured.

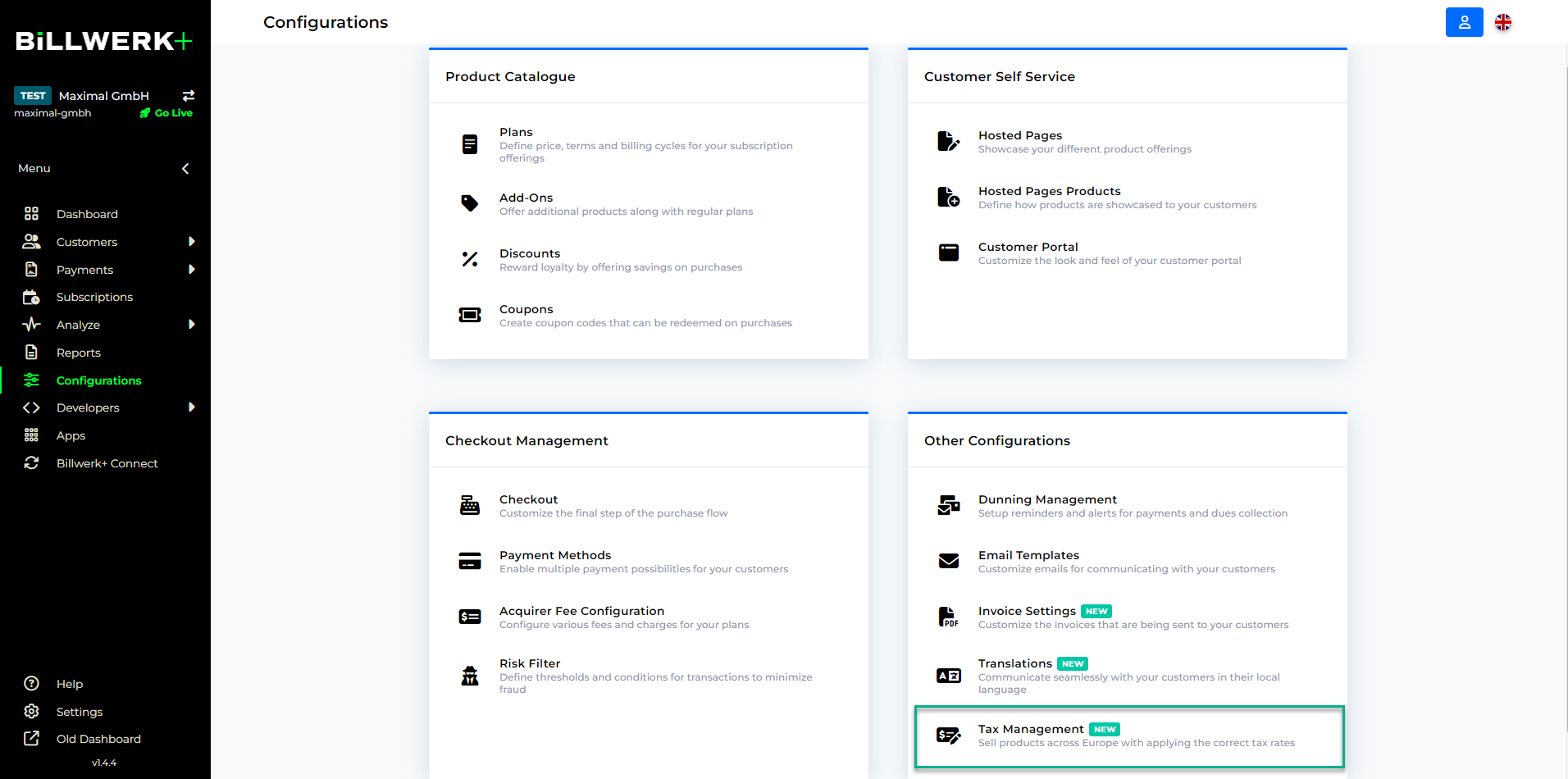

Tax setting configuration

Tax settings are managed under Configuration > Tax Management

|

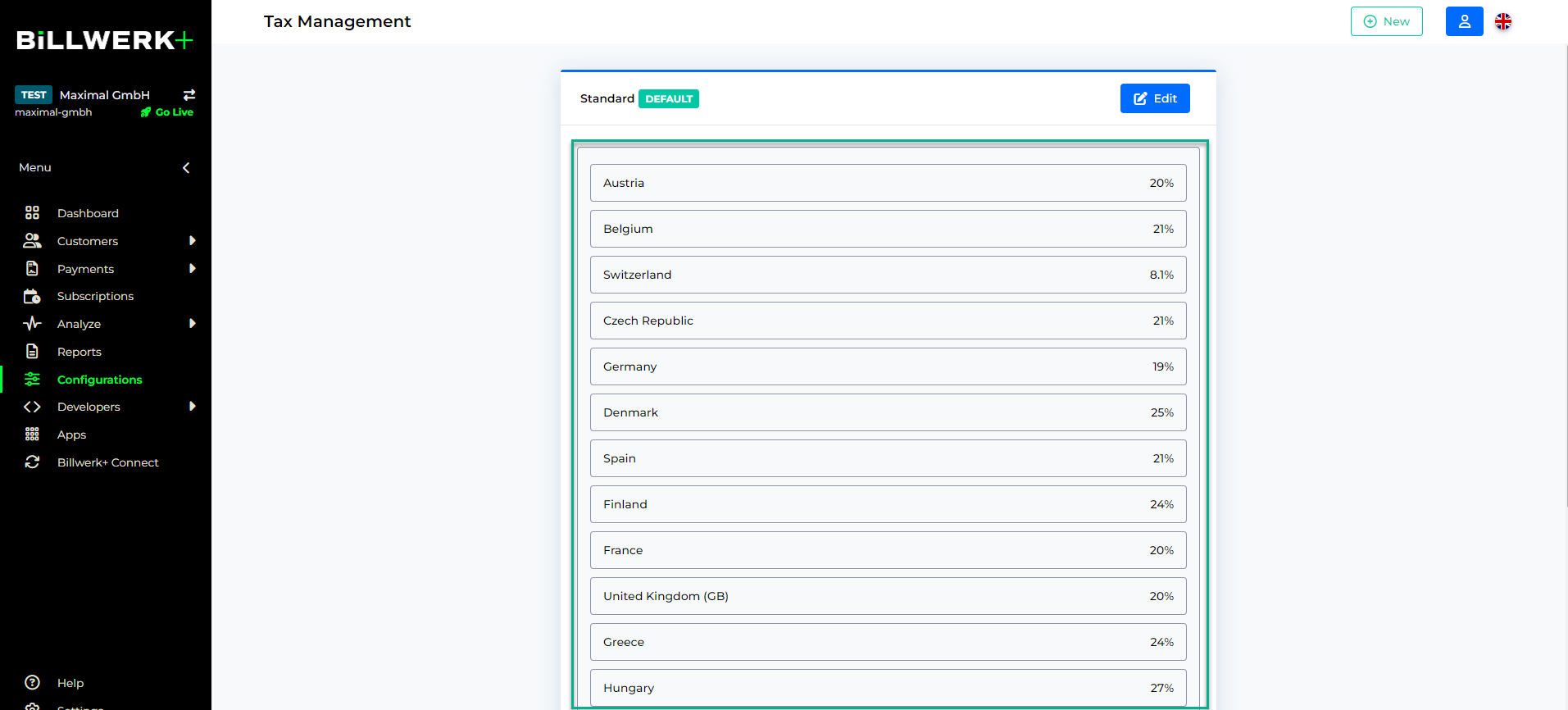

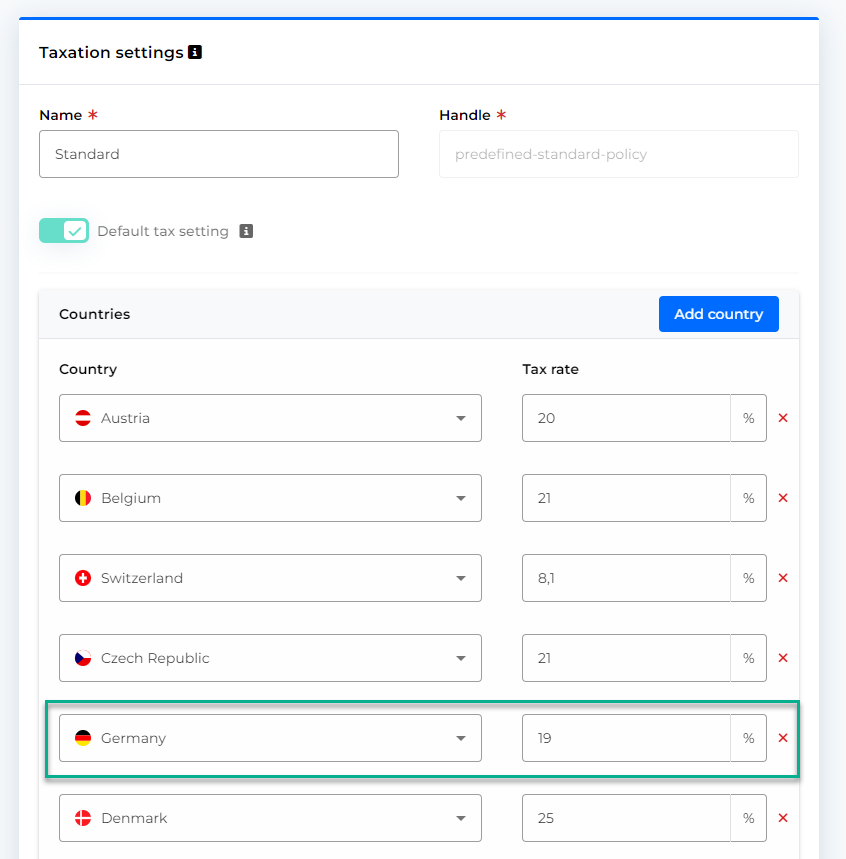

Tax settings consist of a list of countries and VAT rates to be applied for this country.

With each Billwerk+ account we provide a standard Tax setting that contains the standard VAT rate for the 20 most important European countries.

|

Warning

Billlwerk+ does not guarantee these tax rates are up-to-date nor that they apply for your business.

Please carefully review the tax rates and change them accordingly with your tax adviser or finance team.

You can edit existing Tax settings by adding new countries, removing or changing existing countries and their tax rates. Entire Tax settings can also be deleted.

Each Tax setting a an entry “Remaining countries”, which is applied if the concrete country of your customer is not configured. This entry cannot be removed.

If you have different products for which different tax rates apply you can create multiple Tax settings to cater for these different requirements.

Using Tax for invoice creation and products

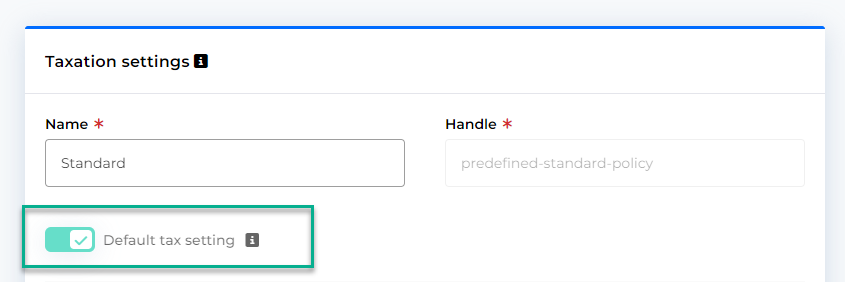

While you can set up multiple Tax settings, only one can be classified as the default setting.

|

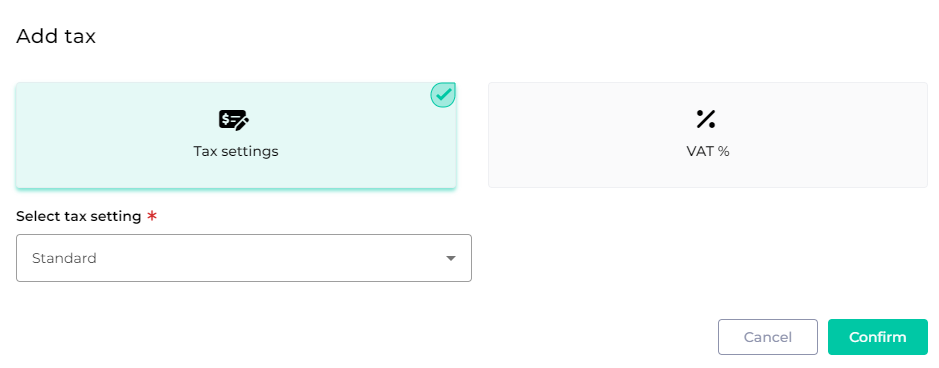

When you crate an invoice or a new product, Billwerk+ will suggest the default Tax setting to be used.

This can be change by you, to either another Tax setting or a flat VAT % rate.

|

Existing products can be changed from a flat VAT % rate to instead use a Tax setting.

How Billwerk+ applies tax rates

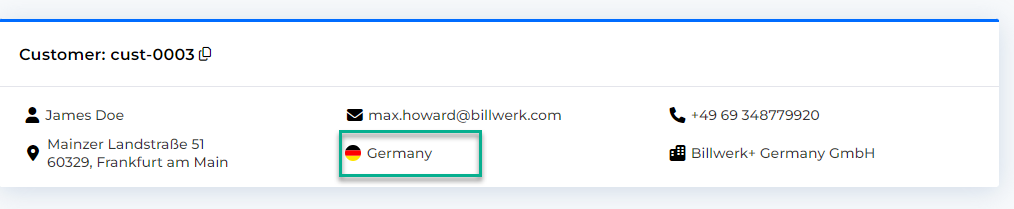

When a product or invoice line item references a Tax setting, Billwerk+ will determine the tax to be applied by checking the country of the customer at hand and looking up the applicable VAT rate in the Tax setting.

Example:

A customer with country Germany is buying a subscription that references the standard Tax setting. 19% tax is applied for that subscription based on the configuration.

|

|

Invoices on Customer level can have a shipping and billing address on top of the regular customer address.

If these additional addresses exist for an invoice, they take precedent in determining the tax country over the normal customer country.

In explicit the priority followed is:

Shipping address country

Billing address country

Customer country

Example:

You create an invoice for a customer with country Denmark. The billing address of the invoice is in Germany and the shipping address in the Netherlands.

In this case, the tax rate for the Netherlands will be applied.

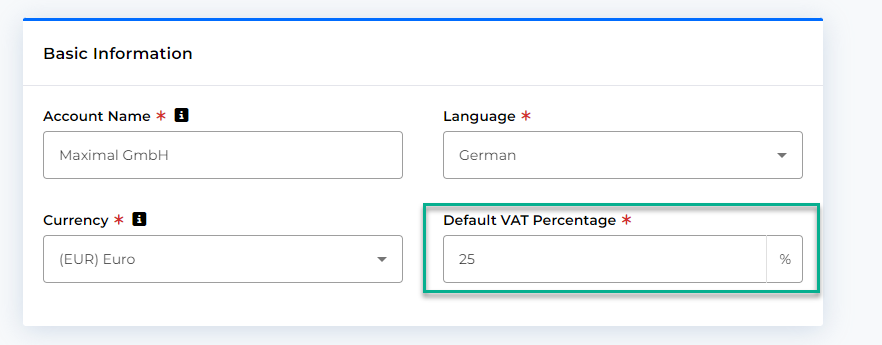

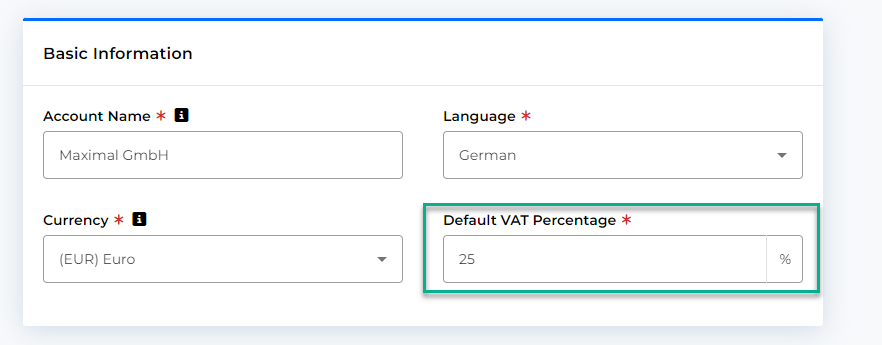

Special case: The customer and invoices does not have any country configured

Notice

If a customer has no country configured Billwerk+ will apply the account Default VAT Percentage, which is configured in the account settings under “Settings > Account”. This setting serves as a global fallback.

|