Tax Management

With our Tax Management functionality you can set up Billwerk+ to automatically determine the value-added tax (VAT) rate to be applied for a purchase based on the country of your customers.

With this you can easily sell you products across Europe while we take care of applying the taxation logic for you.

This functionality enables you to manage different business models with different tax rates in one Billwerk+ account.

Notice

While our Tax Management functionality is powerful, if you do not want to use it, Billwerk+ will continue to work as it used to with the flat % VAT rates you have configured.

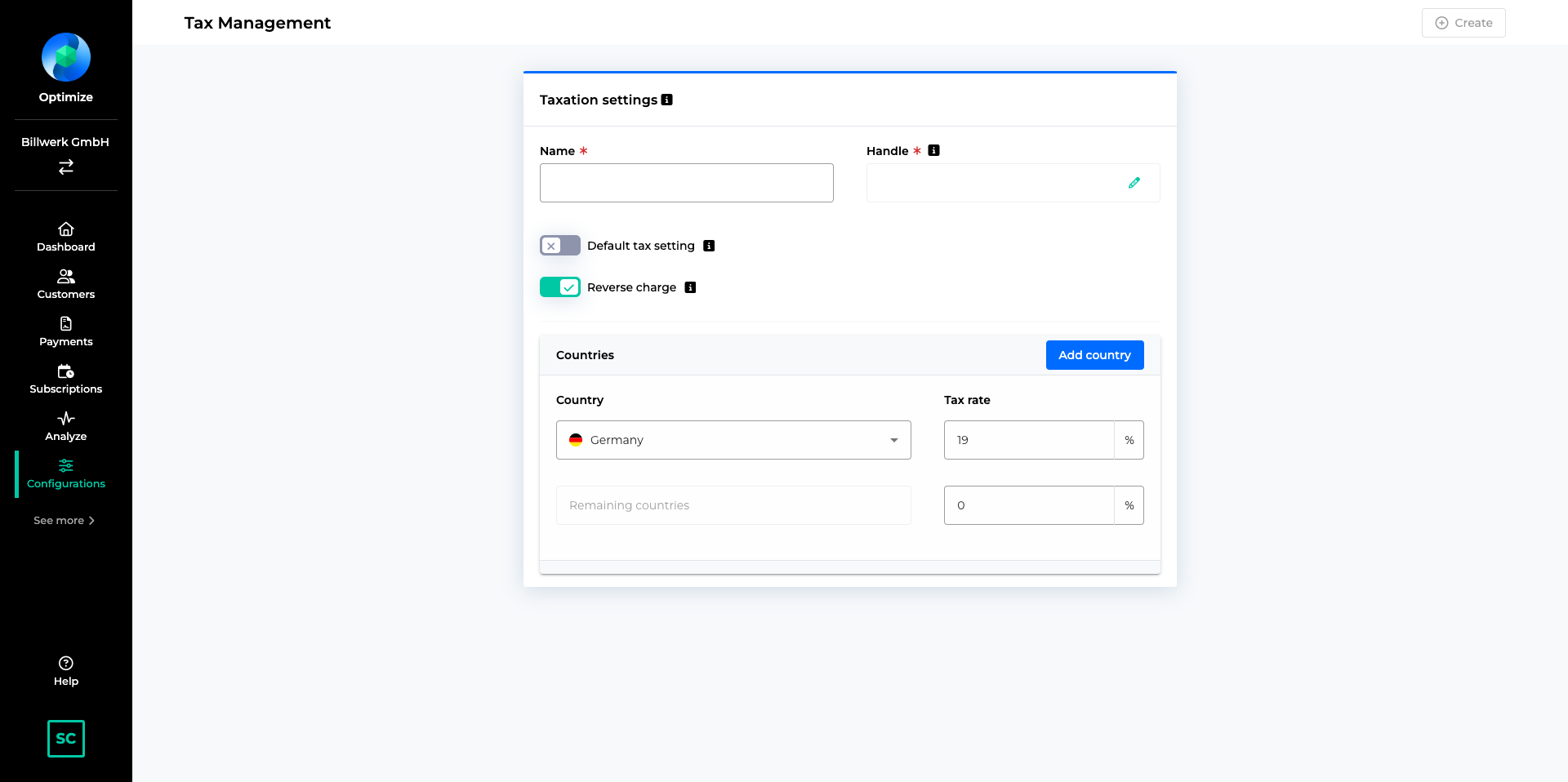

Tax setting configuration

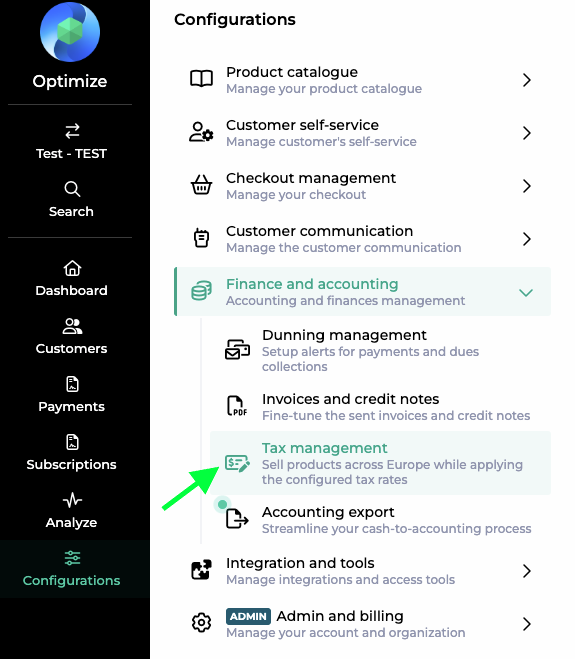

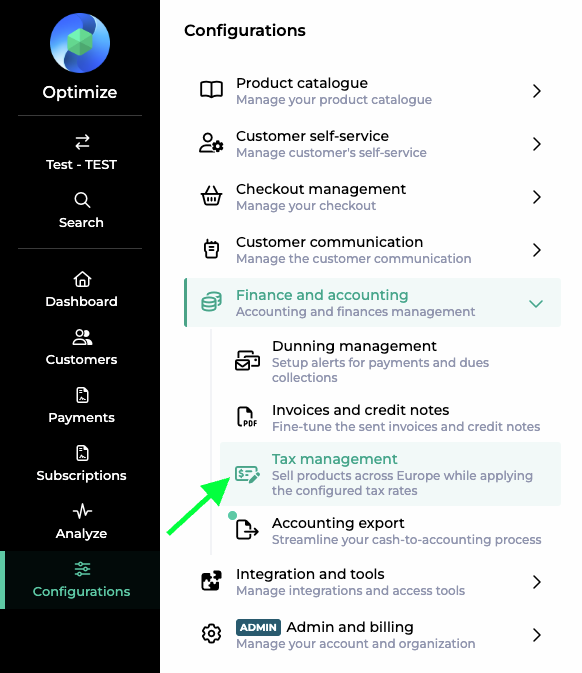

Tax settings are managed under Configurations > Finance and accounting > Tax Management

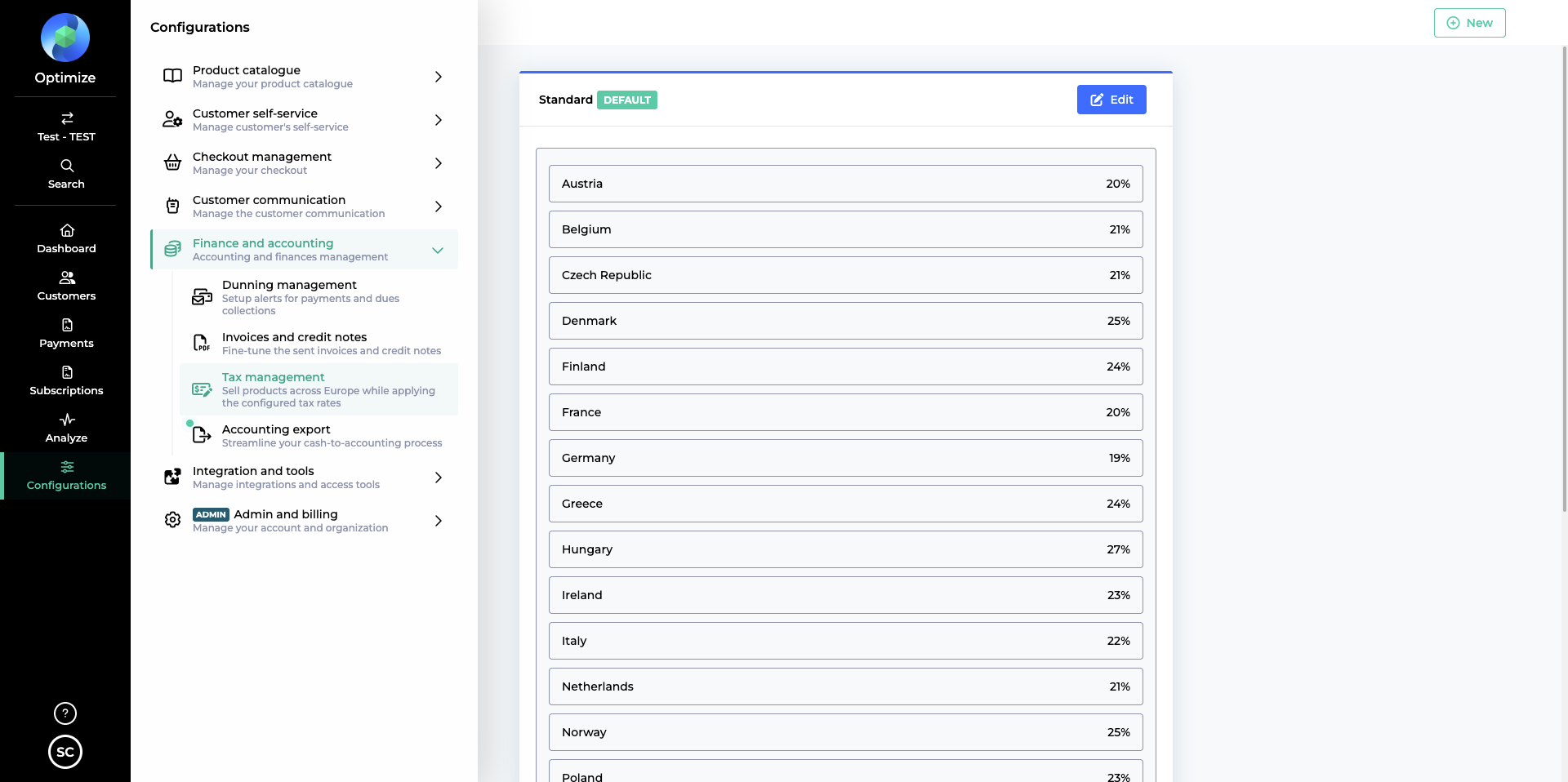

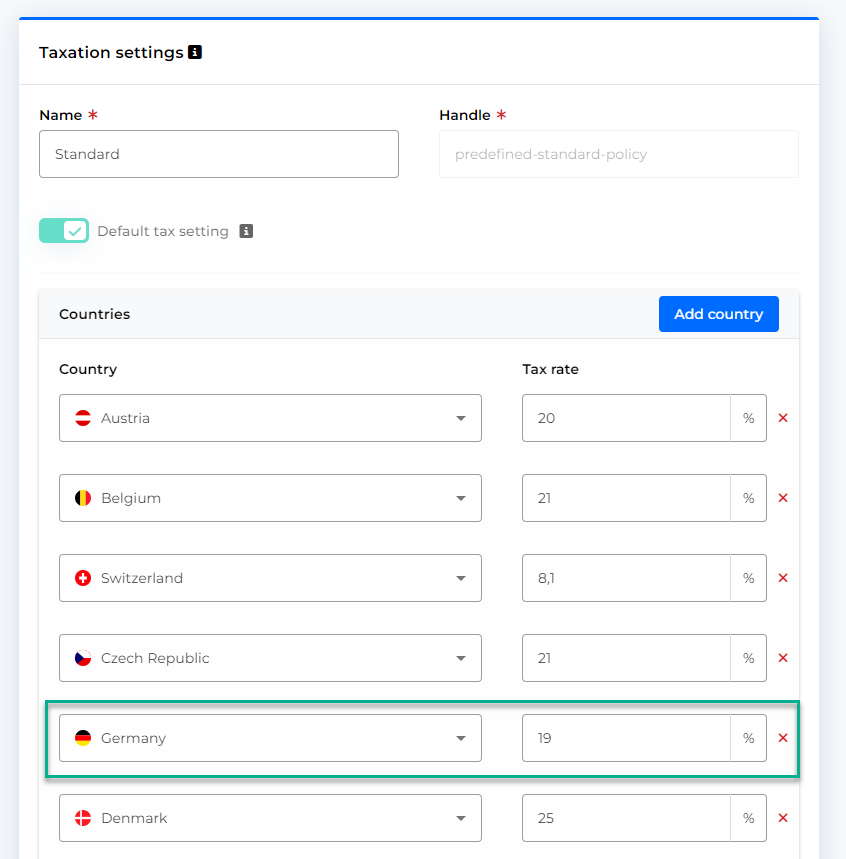

Tax settings consist of a list of countries and VAT rates to be applied for this country.

With each Billwerk+ account we provide a standard Tax setting that contains the standard VAT rate for the 20 most important European countries.

Warning

Billlwerk+ does not guarantee these tax rates are up-to-date nor that they apply for your business.

Please carefully review the tax rates and change them accordingly with your tax adviser or finance team.

You can edit existing Tax settings by adding new countries, removing or changing existing countries and their tax rates. Entire Tax settings can also be deleted.

Each Tax setting a an entry “Remaining countries”, which is applied if the concrete country of your customer is not configured. This entry cannot be removed.

If you have different products for which different tax rates apply you can create multiple Tax settings to cater for these different requirements.

Using Tax for invoice creation and products

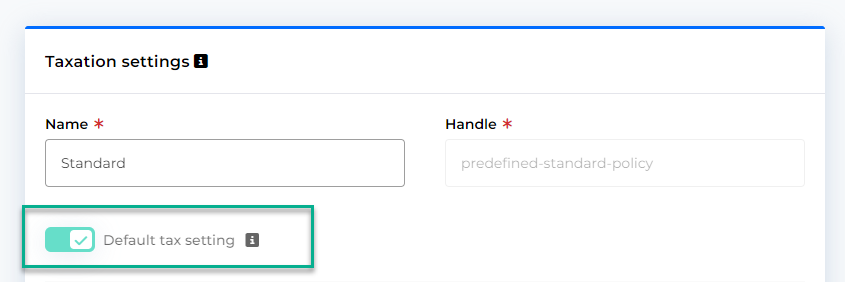

While you can set up multiple Tax settings, only one can be classified as the default setting.

|

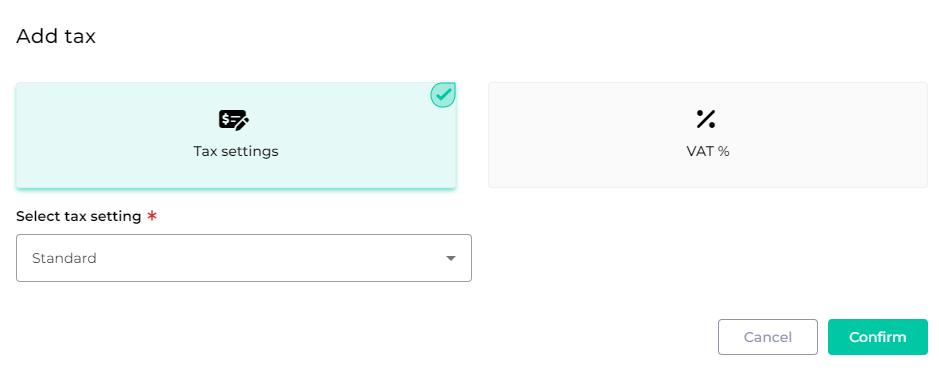

When you crate an invoice or a new product, Billwerk+ will suggest the default Tax setting to be used.

This can be change by you, to either another Tax setting or a flat VAT % rate.

|

Existing products can be changed from a flat VAT % rate to instead use a Tax setting.

How Billwerk+ applies tax rates

When a product or invoice line item references a Tax setting, Billwerk+ will determine the tax to be applied by checking the country of the customer at hand and looking up the applicable VAT rate in the Tax setting.

Example:

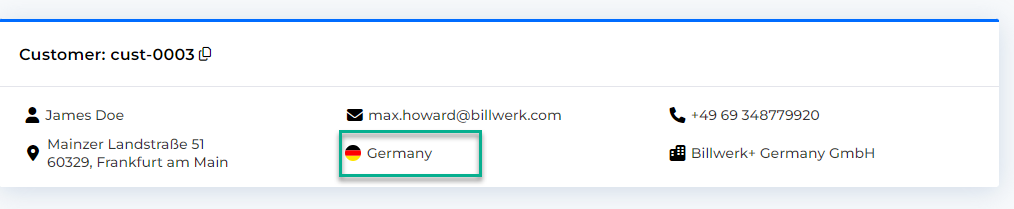

A customer with country Germany is buying a subscription that references the standard Tax setting. 19% tax is applied for that subscription based on the configuration.

|

|

Invoices on Customer level can have a shipping and billing address on top of the regular customer address.

If these additional addresses exist for an invoice, they take precedent in determining the tax country over the normal customer country.

In explicit the priority followed is:

Shipping address country

Billing address country

Customer country

Example:

You create an invoice for a customer with country Denmark. The billing address of the invoice is in Germany and the shipping address in the Netherlands.

In this case, the tax rate for the Netherlands will be applied.

Special case: The customer and invoices does not have any country configured

Notice

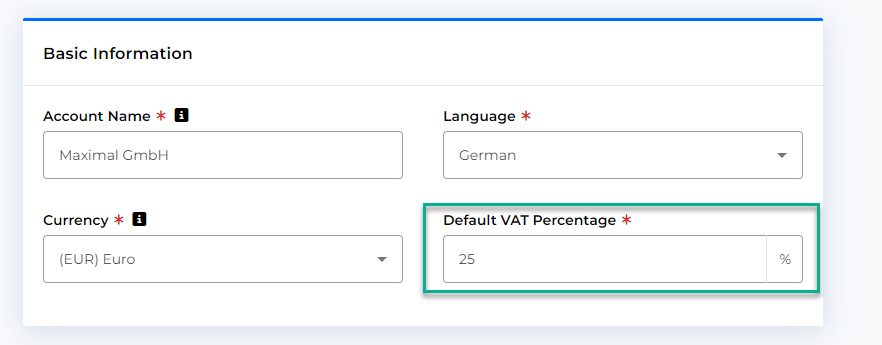

If a customer has no country configured Billwerk+ will apply the account Default VAT Percentage, which is configured in the account settings under “Settings > Account”. This setting serves as a global fallback.

|

Reverse Charge

The reverse charge mechanism shifts the responsibility for reporting VAT (Value Added Tax) from the seller to the buyer. Instead of the seller charging VAT on a transaction and remitting it to the tax authorities, the buyer records and pays the VAT directly. This process is commonly used in cross-border transactions or specific industries to combat tax fraud and simplify tax compliance.

As our user, you can apply Reverse Charge for your customers in other EU countries.

When exactly is the Reverse Charge applied?

There are three minimum conditions that need to be met for the Reverse Charge to be applied on the invoice or the credit note;

The Country of the Customer and Country of your account should be different EU countries

The Customer must have a VAT ID configured

The Plan, Add-On and Usage-based billing product that are part of the subscription must have a Tax Policy where Reverse Charge is enabled

How to enable Reverse Charge on the Tax Policy?

The Reverse Charge functionality has to be configured at a Tax Policy level so that it can be applied on your Plans, Add-ons and Usage-based billing products

Navigate to Configurations > Finance and accounting > Tax Management.

Select an existing Tax Policy or Create a new Tax Policy

Enable the Reverse Policy tab

Use this Tax Policy for all the Plans, Add-Ons and Usage-based product where you would like to apply reverse charge

The text that will be printed on the invoices and credit notes will be visible under Configurations > Invoices and Credit Notes > Reverse Charge

Important

The language of the text is based on the Country of the Account. The language of the Account or the language of the interface has no bearing on the text printed on the Invoice. For ex. if the Country of the Account under Settings > Account is set to Germany, then this text will be printed in German.

Important

In case if you are using the Translations functionality to communicate with your customers in the language of their choice and you have enabled different languages for communication, then the Invoices and Credits notes will be created in the language set on Customer record.

Here is the list of the text that will be printed on the invoices and the credit notes in different languages as determined by Article 226 paragraph 11a of the VAT Directive 2006/112/EC (amending Directive 2010/45/EU of 13 July 2010)

Language | Text |

English | Reverse Charge |

German | Umkehrung der Steuerschuldnerschaft |

Danish | Omvendt betalingspligt |

French | Autoliquidation |

Czech | Daň odvede zákazník |

Greek | Αντίστροφη επιβάρυνση |

Spanish | inversión del sujeto pasivo |

Finnish | Käännetty verovelvollisuus |

Swedish | Omvänd betalningsskyldighet |

Hungarian | Fordított adózás |

Italian | Inversione contabile |

Dutch | Btw verlegd |

Norwegian | Skatt skal betales på grunnlag av omvendt avgiftsplikt |

Polish | Odwrotne obciążenie |

Serbia | Порез се плаћа на основу обрнуте накнаде |

Romanian | Taxare inversă |

Slovenian | Reverse Charge |

What scenarios are we supporting?

Intracommunity-service (EU-countries):

If an invoice is issued to a Danish merchant by a German merchant, then the sentence for intracommunity-service will appear on the invoice PDF in the language of the PDF.

If a credit note is issued to a Danish merchant by a German merchant, then the sentence for intracommunity-service will appear on the credit note PDF in the language of the PDF.

Domestically non-taxable service (non-EU countries):

If an invoice is issued to a UK merchant by a German merchant, then the sentence for reverse charge-sales will appear on the invoice PDF in the language of the PDF.

If a credit note is issued to a UK merchant by a German merchant, then the sentence for reverse charge-sales will appear on the credit note PDF in the language of the PDF.

For all other sales (B2B domestic + B2C) there will not be any additional sentence on the invoice / credit note PDF.

On Demand Order Lines in Invoices and Credit Notes

In case of On Demand Order lines on Invoices and Credit Notes, the Billwerk+ Optimize checks for the Shipping Address, followed by the Billing Address (if Shipping Address doesn't exist) and the Customer's address (if the billing address doesn't exist) to apply the Reverse Charge Rule.

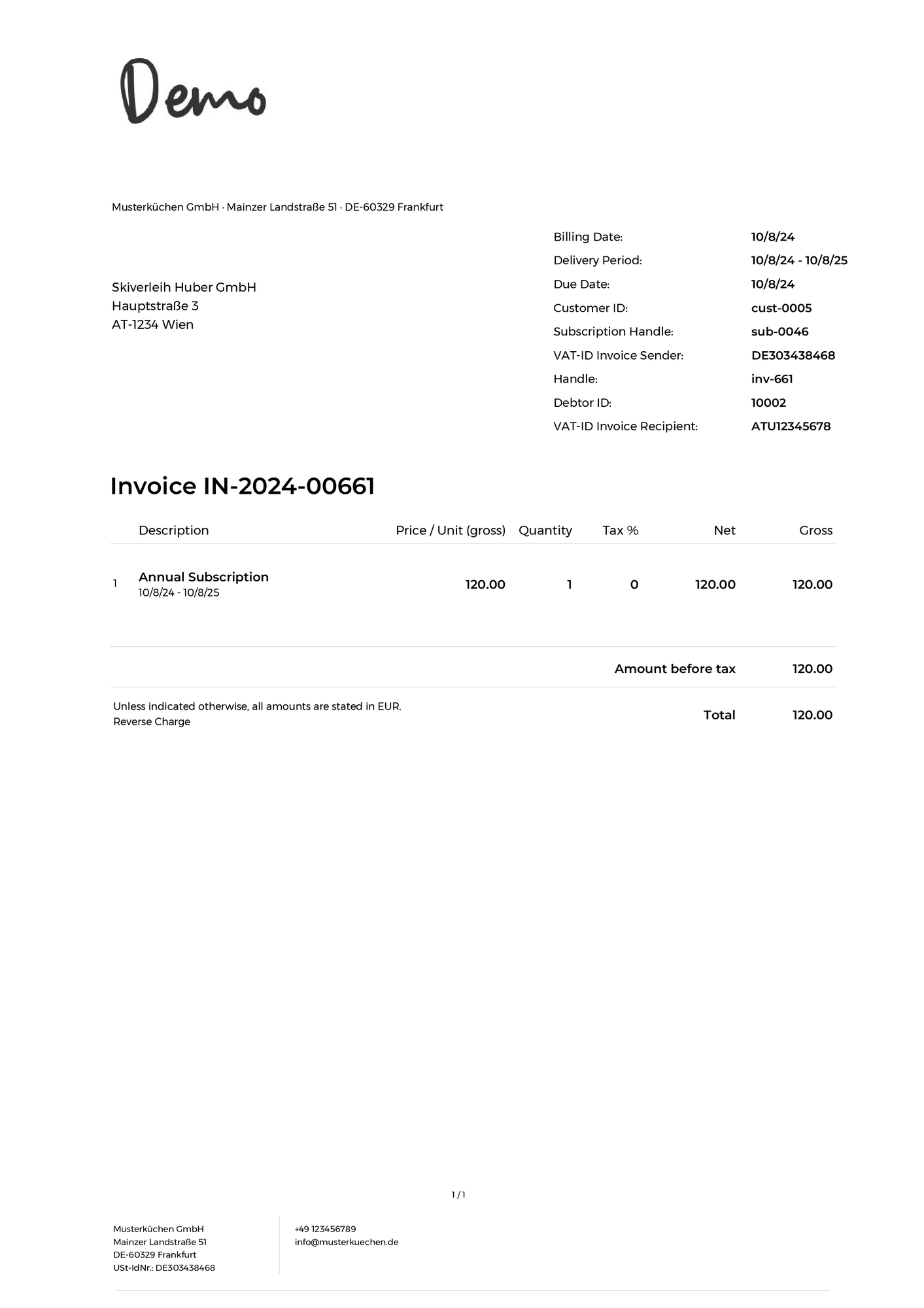

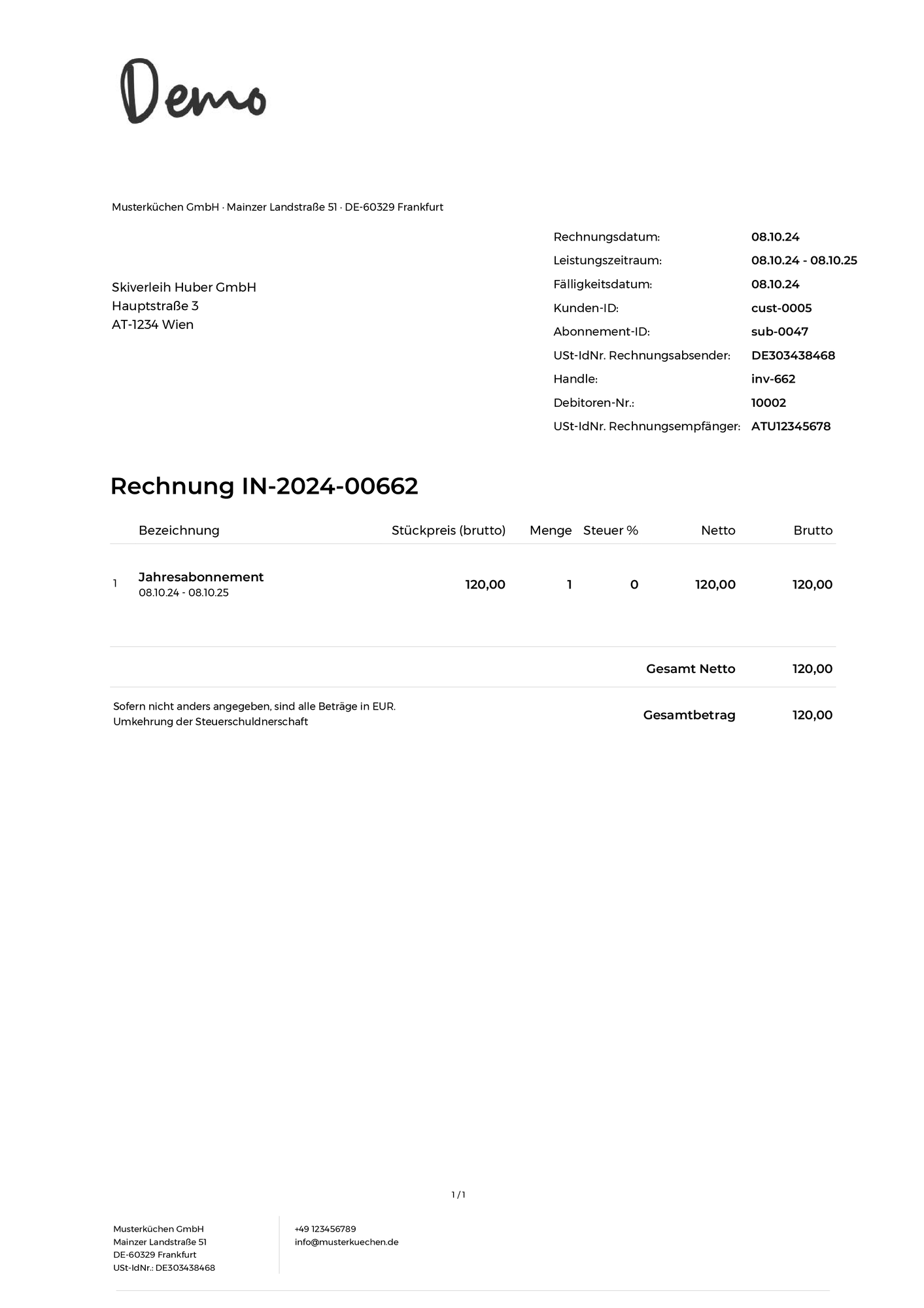

Sample PDF Invoices

Sample 1

|

Sample 2

|