Account settings

This section is very self-explanatory. For the purpose of a complete documentation, we will explain it anyway :)

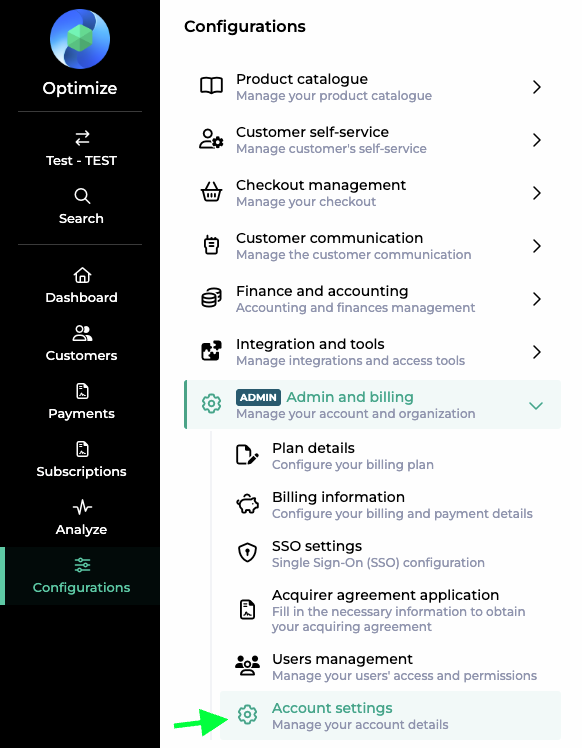

You can find this page under Configurations > Admin and billing > Account settings

Note

Please be aware that this information is displayed to your customers in the email templates or in the checkout window.

These are the fields you can fill in about your company, address and contact:

Basic Information | Account Name |

Language You can set the language in the Account, but also in the User profile. NoteThe account language is overwriting the user profile language in Email templates. | |

Currency | |

Default VAT Percentage | |

Location | Address |

Postal Code | |

Address 2 | |

City | |

Country | |

Timezone | |

VAT ID NotePlease use the country code followed by the number. For more details on the correct VAT format as per each country, please refer the following document | |

Contact Information | |

Phone | |

Website | |

Logo | Upload |

Terms of Service | You have a rich text editor at your disposition. A draft containing standard terms of services is already available. You can adapt it to your business needs. |

Advanced | Set a Subscription invoice prefix:

|

Click on  to finalize your setup.

to finalize your setup.

VAT Id Information

The VAT Id entered in Billwerk needs to follow a particular format so that the VAT validation doesn't fail.

Below you can find the list of valid VAT formats for all EU countries

Country / Code | Format | Example |

|---|---|---|

Austria / AT | AT + 9 characters | ATU12345678 |

Belgium / BE | BE + 10 characters | 1234567890 |

Bulgaria / BG | BG + 9 or 10 characters | BG123456789 or BG0123456789 |

Croatia / HR | HR + 11 characters | HR01234567891 |

Czech Republic / CZ | CZ + 8, 9 or 10 characters | CZ12345678, CZ123456789, or CZ0123456789 |

Denmark / DK | DK + 8 characters | DK12345678 |

Estonia / EE | EE + 9 characters | EE123456789 |

Finland / FI | FI + 8 characters | FI12345678 |

France / FR | FR + 11 characters | FR12345678901 |

Germany / DE | DE + 9 characters | DE123456789 |

Greece / EL | EL + 9 characters | EL123456789 |

Hungary / HU | HU + 8 characters | HU12345678 |

Ireland / IE | IE + 8 characters | IE1234567X |

Italy / IT | IT + 11 characters | IT12345678901 |

Latvia / LV | LV + 11 characters | LV12345678901 |

Lithuania / LT | LT + 9 or 12 characters | LT123456789 or LT123456789012 |

Luxembourg / LU | LU + 8 characters | LU12345678 |

Malta / MT | MT + 8 characters | MT12345678 |

Netherlands / NL | NL + 12 characters | NL123456789B01 |

Norway / NO | NO + 9 digits and the letters + MVA | NO123456789MVA |

Poland / PL | PL + 10 characters | PL1234567890 |

Portugal / PT | PT + 9 characters | PT123456789 |

Republic of Cyprus / CY | CY + 9 characters | CY12345678X |

Romania / RO | RO + 2 to 10 characters. | RO12, RO123, RO1234, RO12345, RO123456, RO1234567, RO12345678, RO123456789, or RO1234567890 |

Slovak Republic / SK | SK + 10 characters | SK1234567890 |

Slovenia / SI | SI + 8 characters | SI12345678 |

Spain / ES | ES + 9 characters | ES123456789 |

Sweden / SE | SE + 12 characters | SE123456789012 |

Switzerland / CH | CH + 9 digits + MWST, TVA, or IVA

| CH123456789MWST, CH123456789TVA, or CH123456789IVA |

Turkey / TR | TR + 10 characters | TR1234567890 |

United Kingdom / GB | GB + 9 digits | GB123456789 |