Accounting Exports

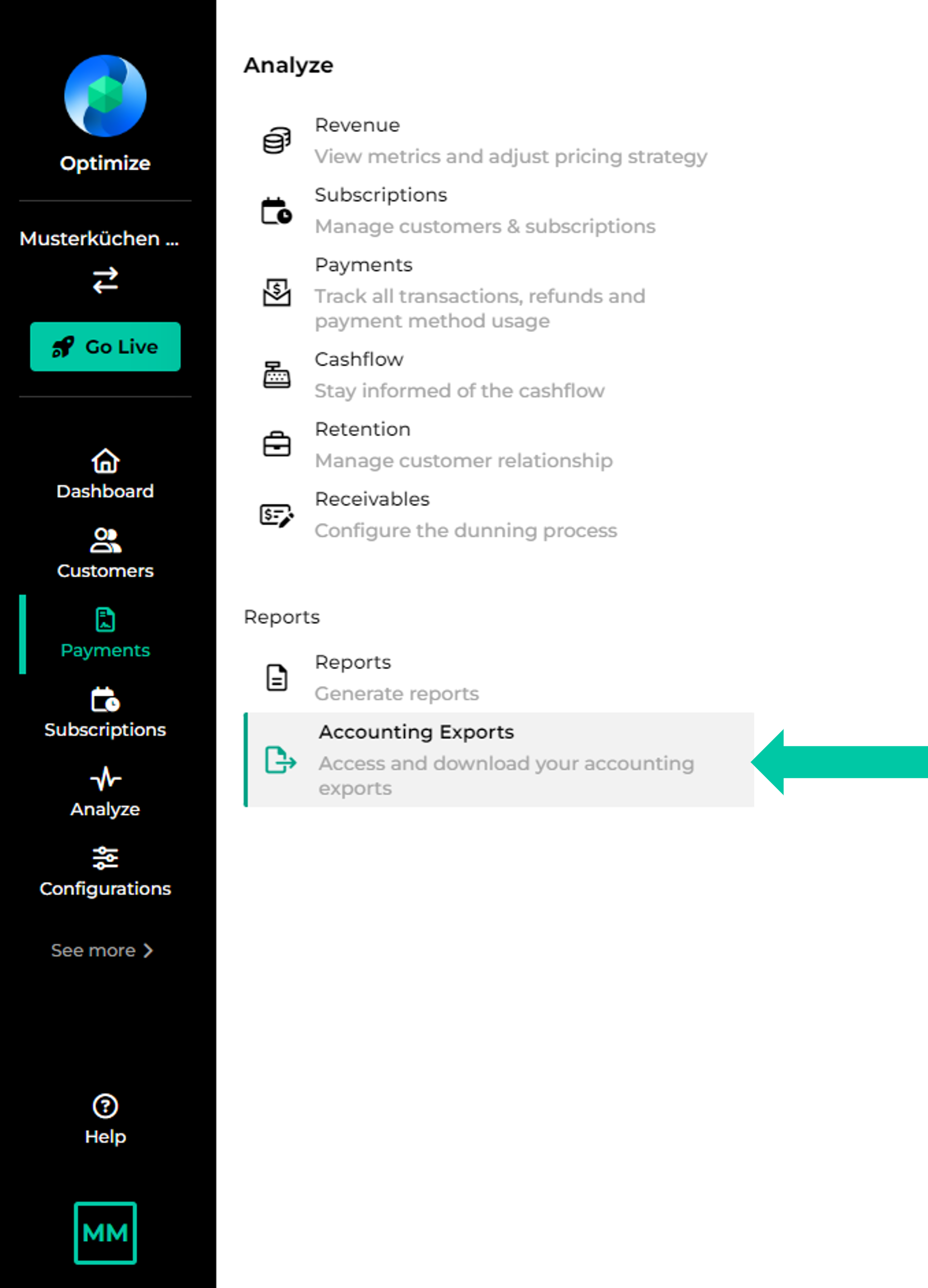

You can access a list of all available accounting export files under Analyze > Accounting Export.

|

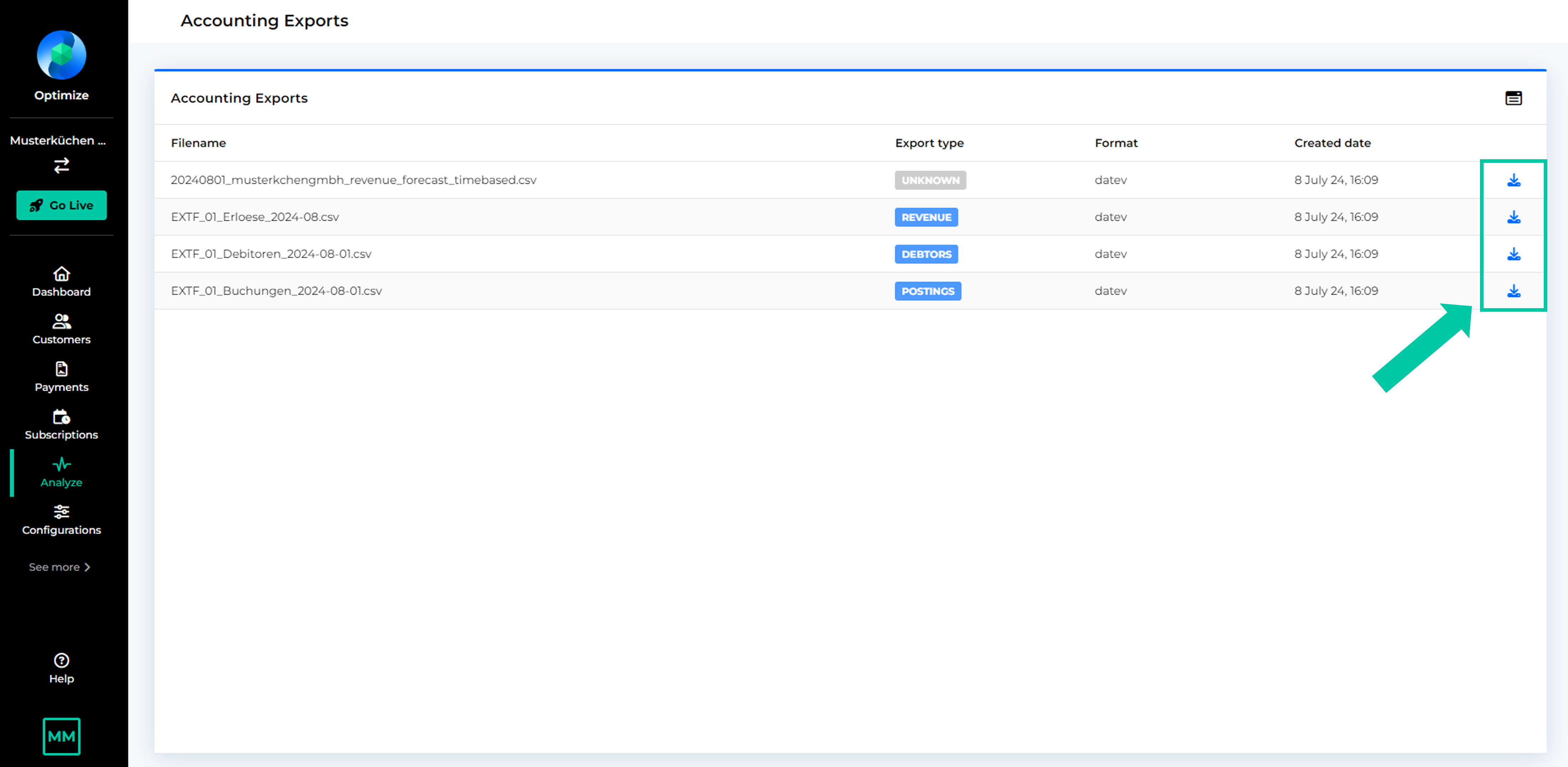

Files can then be downloaded via click on the  -icon.

-icon.

If you have selected “DATEV” as your accounting export format, we provide the following files:

Export type | Description | Interval |

|---|---|---|

Debtor export | Contains the debtor master data for the current accounting period. | monthly / weekly / daily (as configured, see here) |

Bookings export | Contains postings for invoices, credit notes issued during the current accounting period as well as for the respective payments that were collected from / refunded to the customers. (Payments will only appear if they are at least in the status “settled”.) | monthly / weekly / daily (as configured, see here) |

Revenue export | For subscriptions that are billed upfront for longer periods, revenue is recognized over time. The revenues recognized for each accounting period are recorded in the revenue export. | monthly |

Revenue forecasts | For subscriptions that are billed upfront for longer periods, revenue is recognized over time. This file shows how and when revenues will be recognized in the future. | monthly |

Invoices | Contains a list of all invoices and credit notes that have been issued within the export interval. This list is available as PDF ans CSV. | monthly / weekly / daily (as configured, see here) |

If you have selected “CSV” as your accounting export format, we provide the following files:

Export type | Description | Interval |

|---|---|---|

Bookings export | Contains postings for invoices, credit notes issued during the current accounting period as well as for the respective payments that were collected from / refunded to the customers. (Payments will only appear if they are at least in the status “settled”.) | monthly / weekly / daily (as configured, see here) |

Revenue export | For subscriptions that are billed upfront for longer periods, revenue is recognized over time. The revenues recognized for each accounting period are recorded in the revenue export. | monthly |

Revenue recognition

The export files containing revenue postings are generated at the end of each month.

Revenue is recognized when a performance obligation is satisfied with a customer. That's why revenue is distributed evenly over the number of days of the duration of the subscription.

The total number of days is based on 360 days per year and each month is taken into account equally with 30 days.

As the performance period can also start within a month, the recognition rates for the first and last month of the performance period are calculated separately as follows:

Days in the first month = 30 - start date of the performance period + 1

The 30th is the start date if:

the start date is the 31st of a month,

the start date is February 28 in a non-leap year,

the start date is February 29 in a leap year.

Days in the last month = end date of the performance period - start date of the performance period + 1

Bookings

Invoices and credit notes

For every invoice line item in a given period, the line items is first recorded in the “Buchungen”-file. For line items that span over multiple accounting periods, amounts are first collected on the respective deferrals account as mentioned above.

Tip

Deferred income is recognized based on the net amount of a receivable, as the VAT for the entire receivable is due immediately.

If a line items doesn’t have a period, but a single delivery date and if that date falls into the current month, then the line item is booked on the respective revenue account right away (for example for additional costs).

Percentage-discounts are factored into the line item and the discounted amount is reflected in the accounting export.

Credit notes are handled analogously.

Payments and refunds

Payments and refunds are also part of the bookings file. Payments will only appear if they are at least in the status “settled”.

Tip

In you are using offline payments, it might be useful to settle payments within the accounting period in order to include them in your accounting export.